Whistler Real Estate Market Update – Q3 2025

A stable market with shifting dynamics across property types

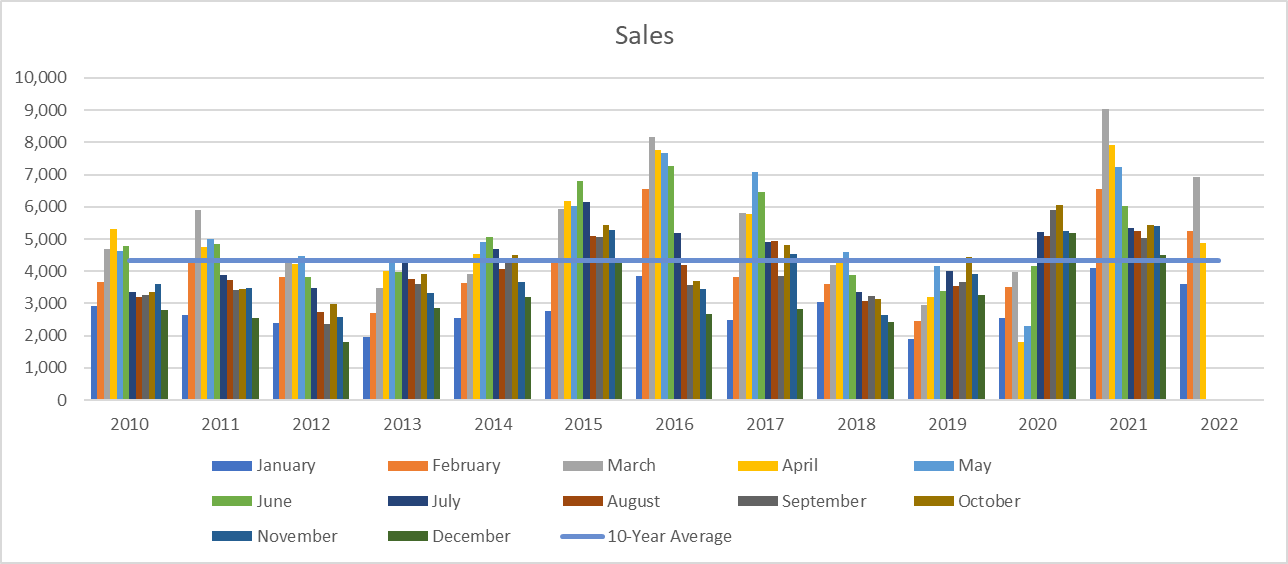

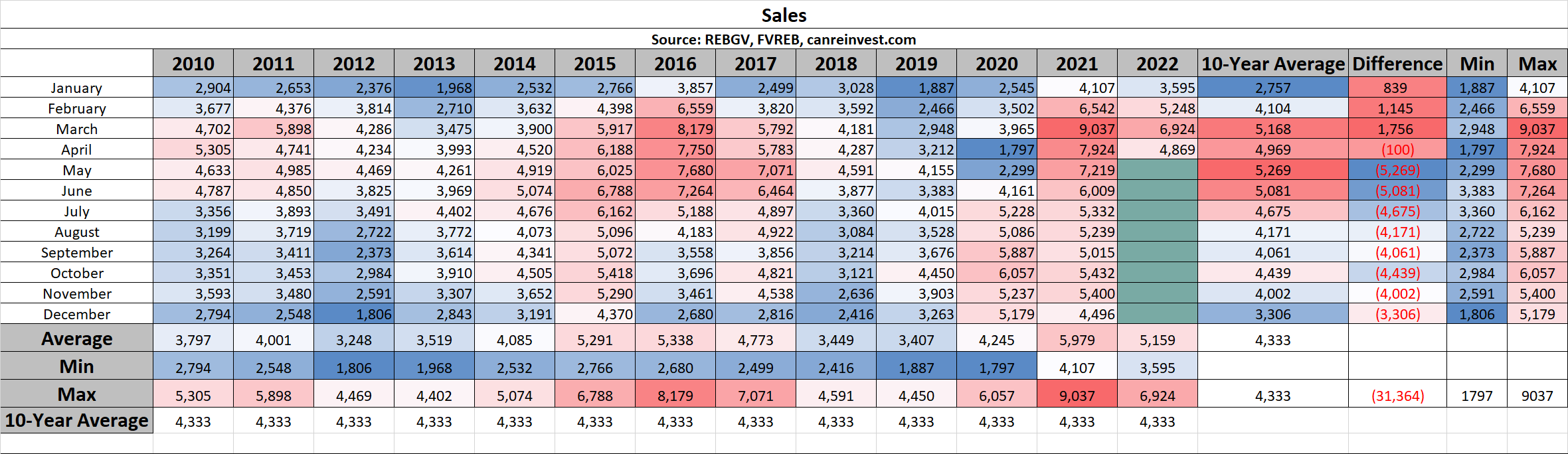

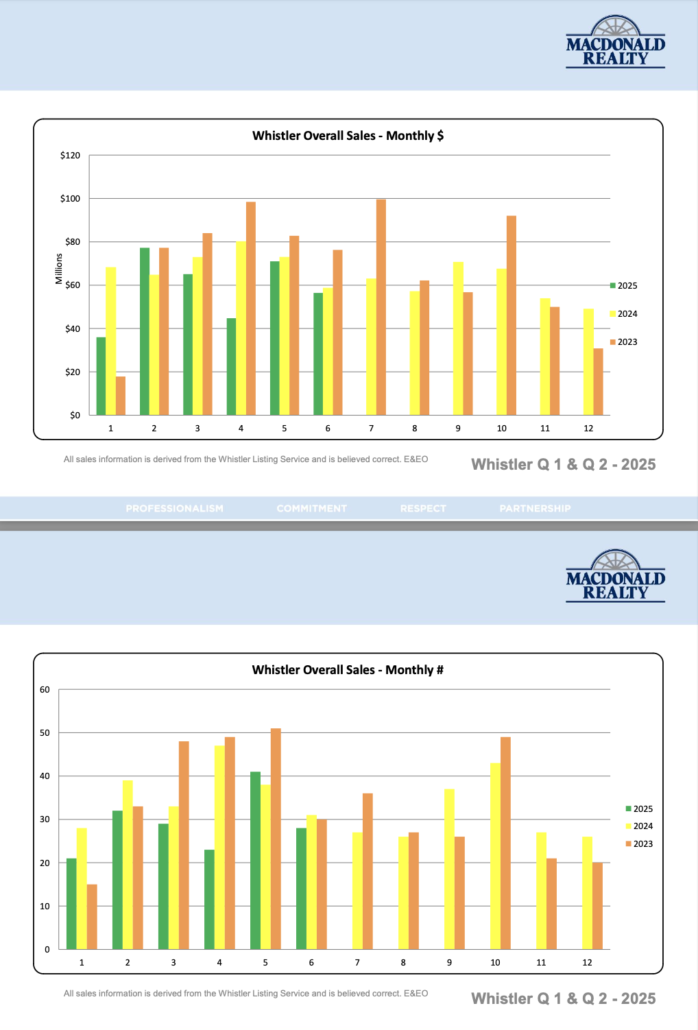

As we wrap up the third quarter of 2025, Whistler’s real estate market continues to show resilience and balance, even as activity levels reflect a more measured pace. While the total number of sales slowed slightly compared to the previous quarter, pricing across most property types remained steady, with some segments even seeing modest gains.

Sales & Market Activity

-

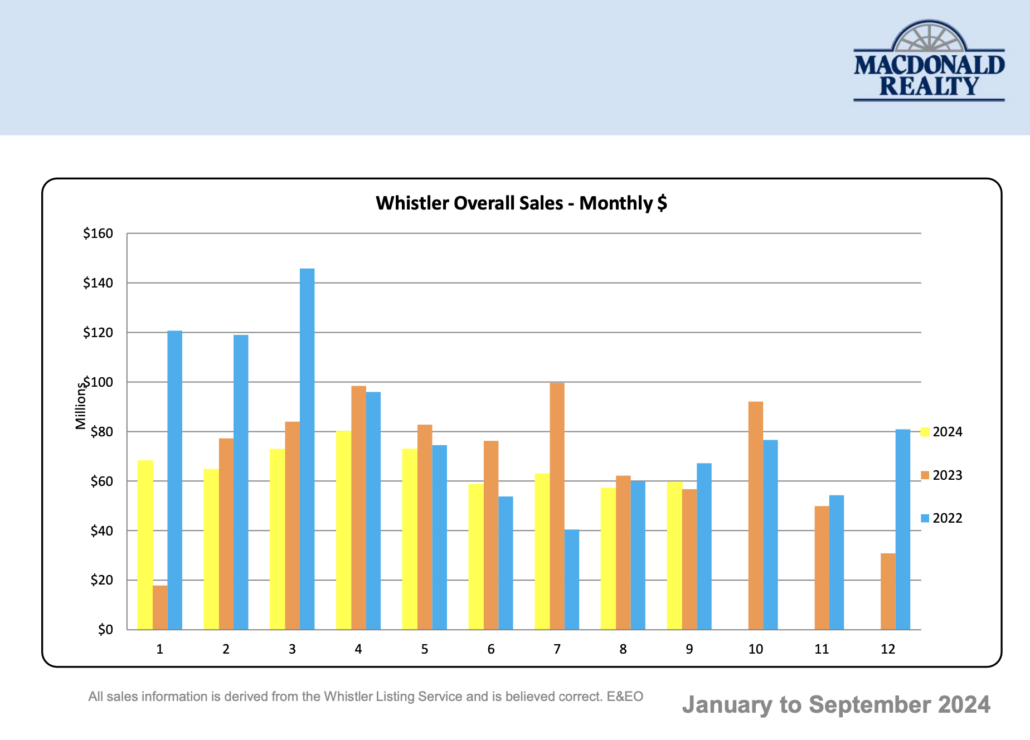

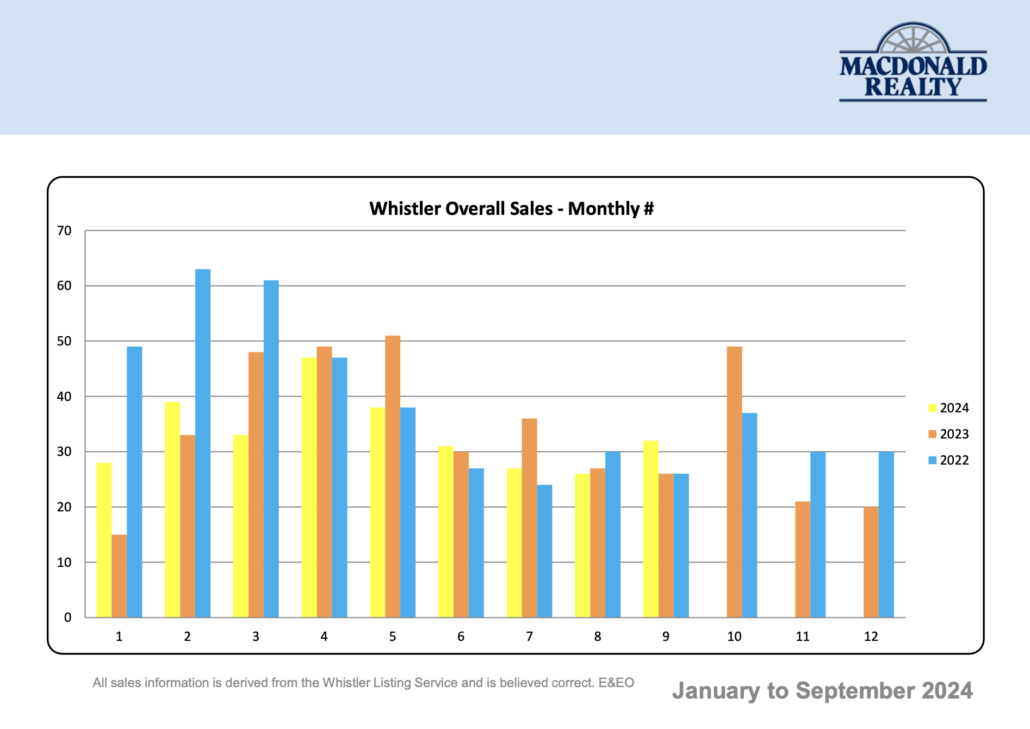

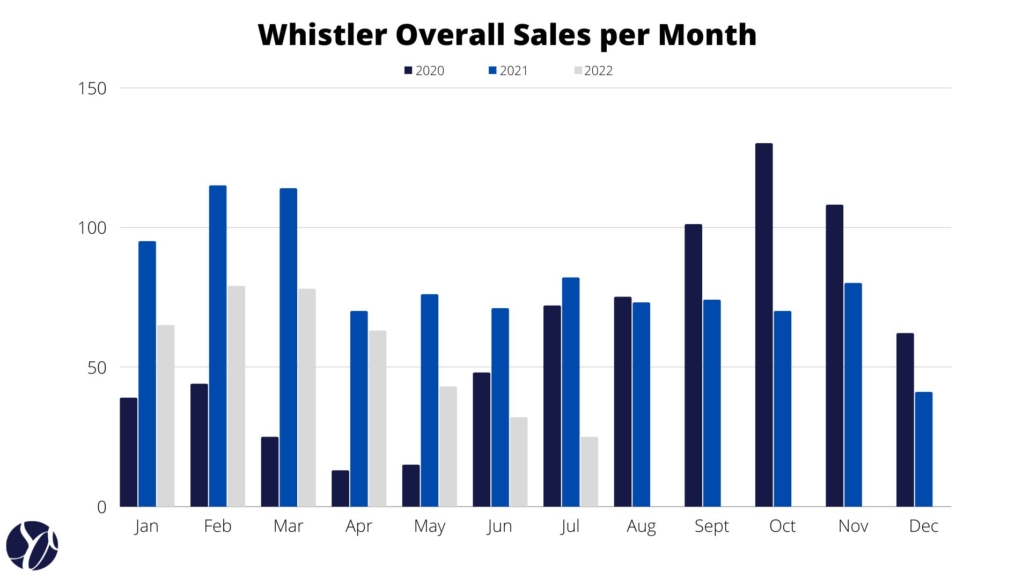

Whistler recorded 106 transactions in Q3 2025, reflecting a 9% decline from Q2 and a modest drop compared to the same quarter last year.

-

The market’s slower pace is consistent with summer behavior in past years, but the fact that activity is continuing — even in a subdued environment — speaks to underlying demand.

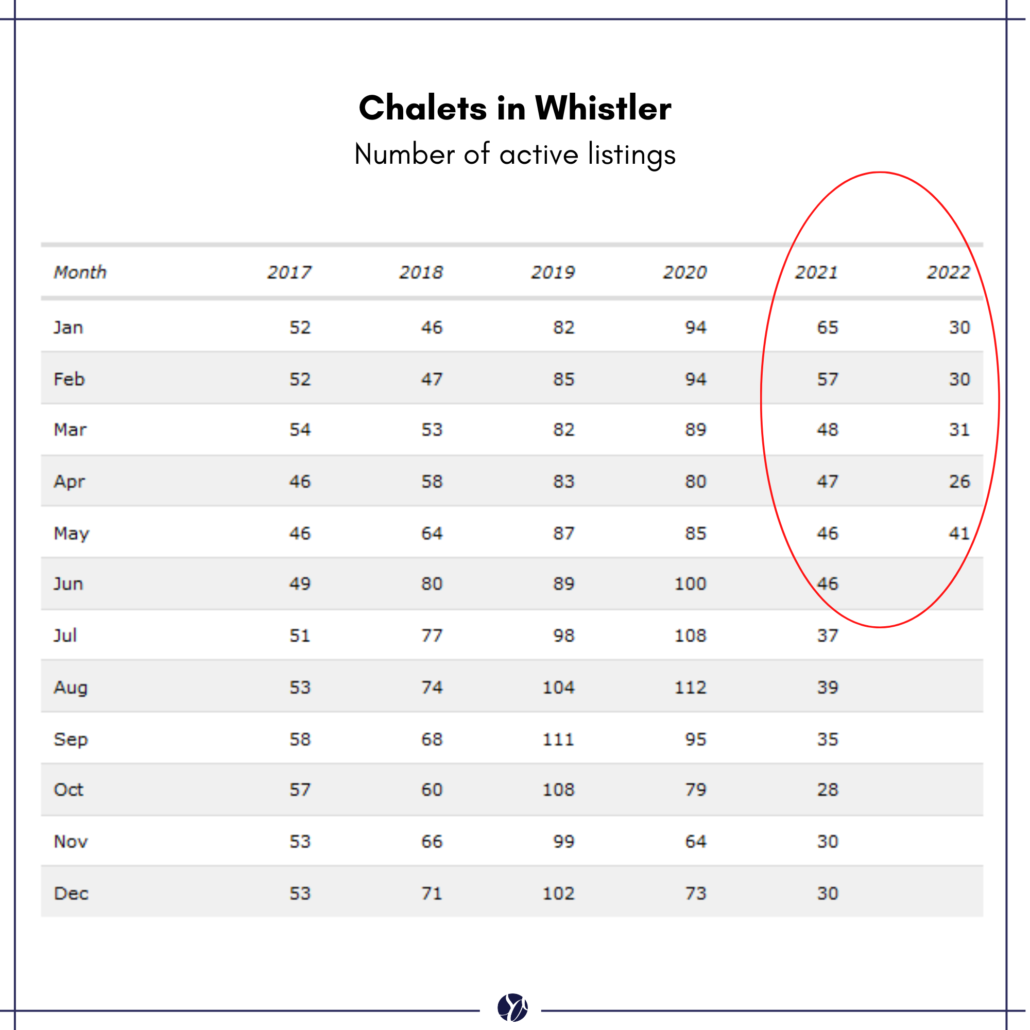

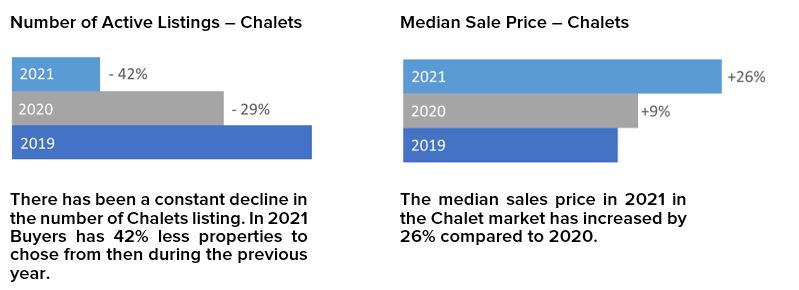

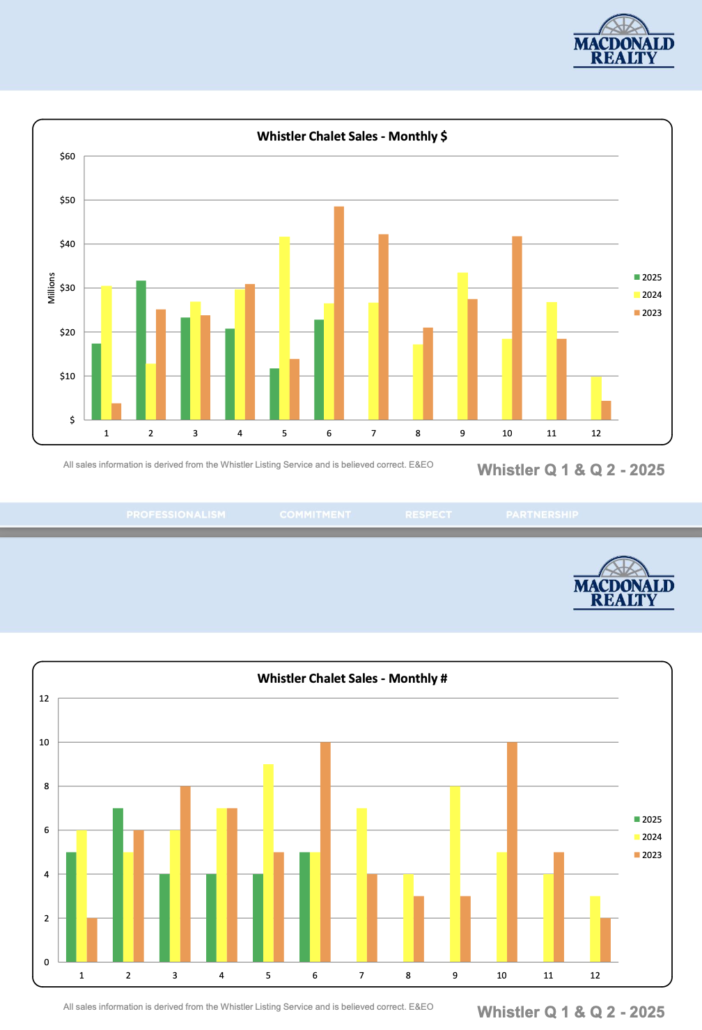

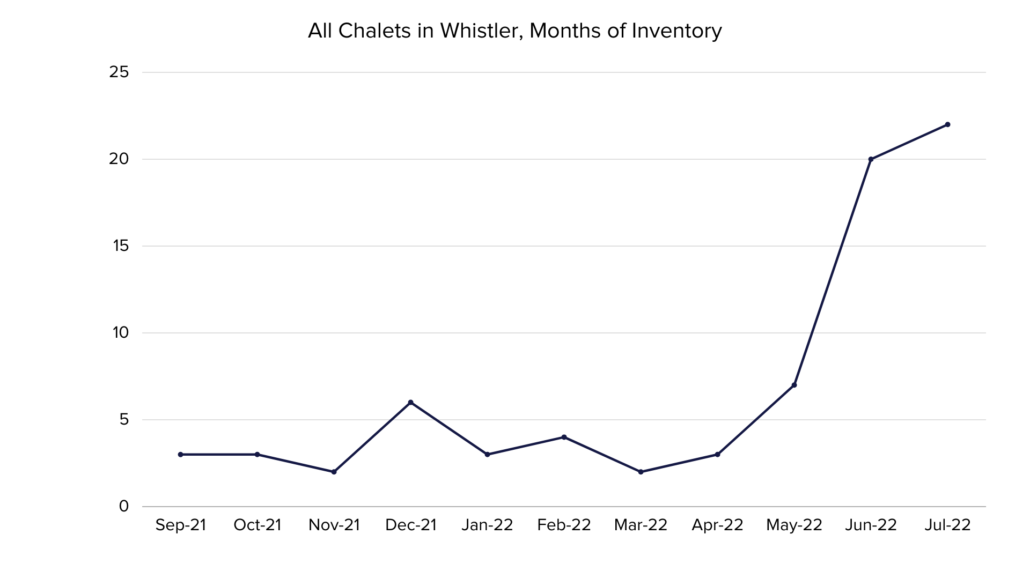

Chalets

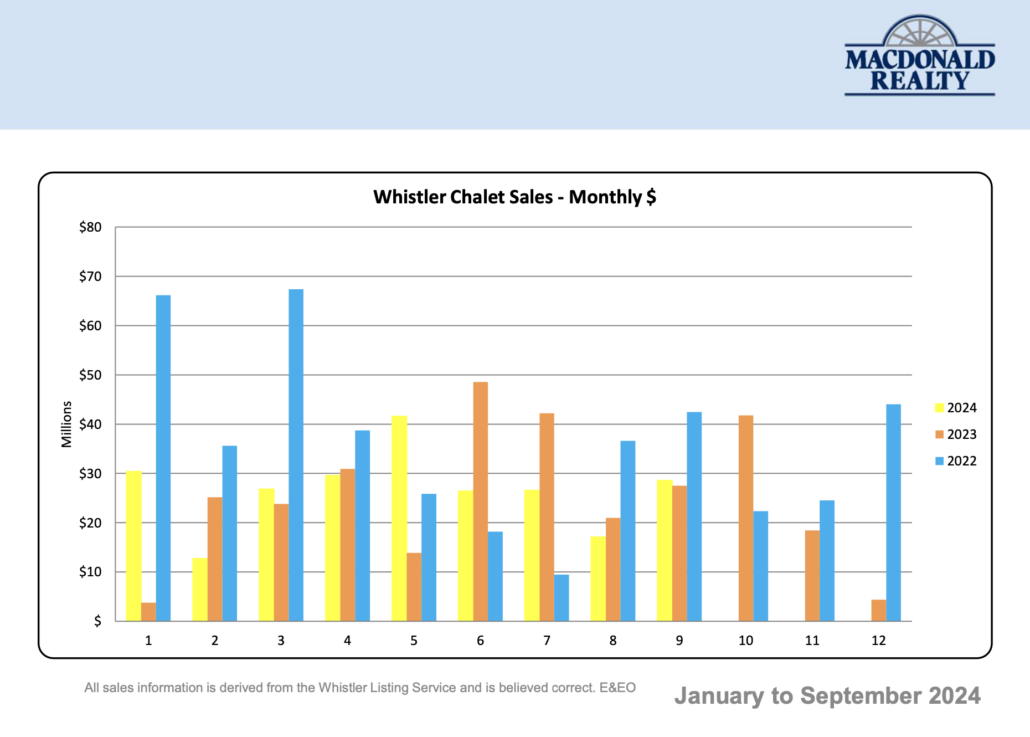

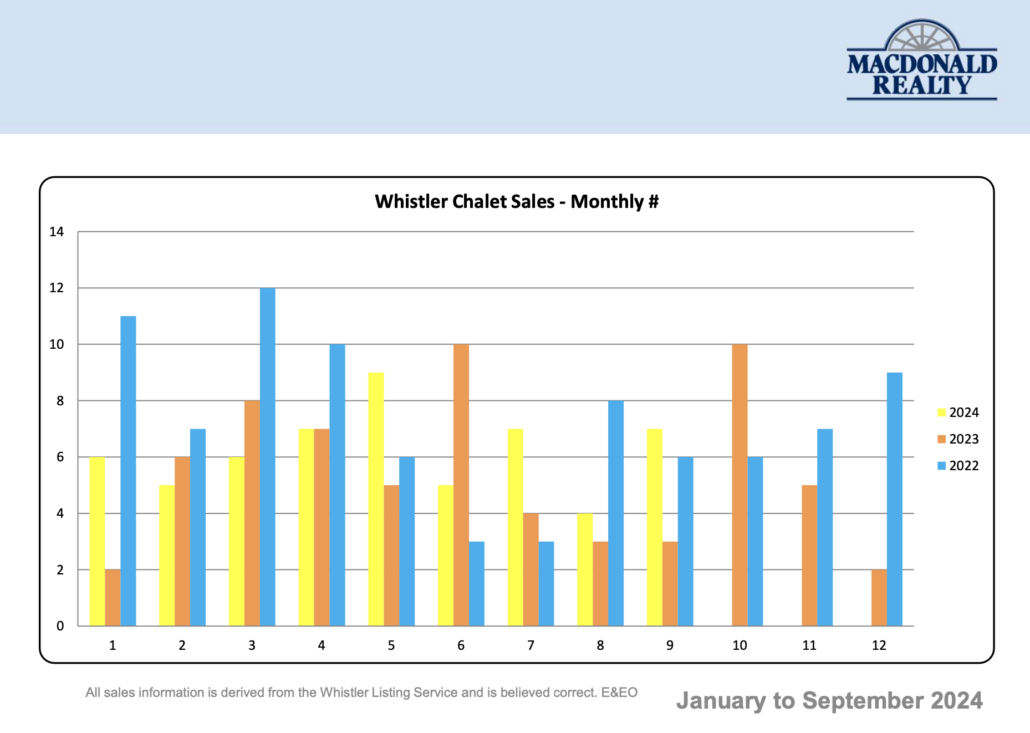

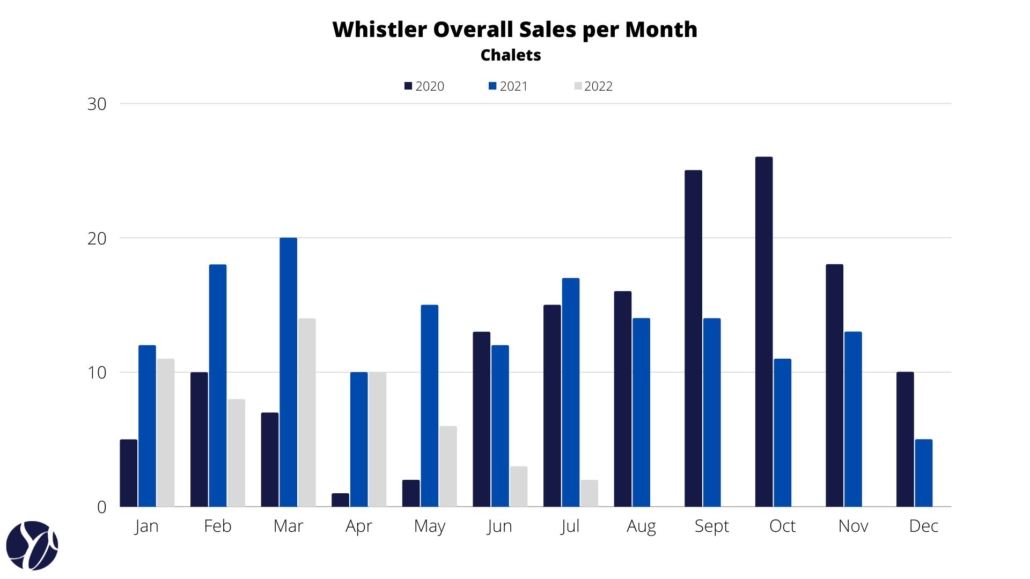

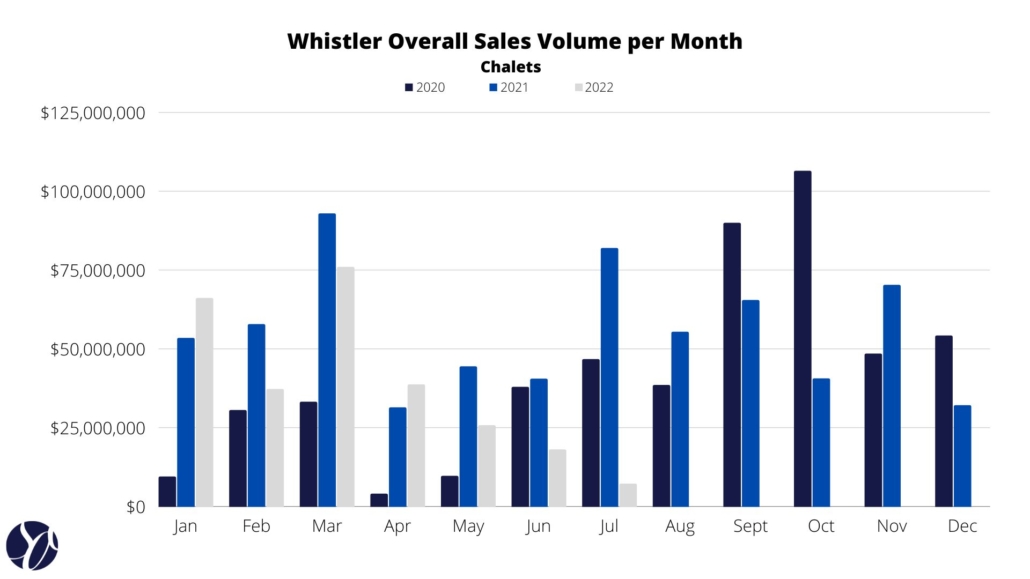

Sales activity in Whistler’s chalet market eased through Q3, with 15 sales, down 17% from Q2 and 25% year-over-year.

The median sale price held relatively firm at $3.36 million, just 1% below last quarter and 5% lower than last year, demonstrating that demand for quality single-family homes remains consistent.

The average days on market rose to 91 days, up slightly from Q2, as buyers took more time to make decisions. Inventory levels were stable at 92 active listings.

📊 Summary: Fewer transactions, but pricing stability suggests a confident luxury segment.

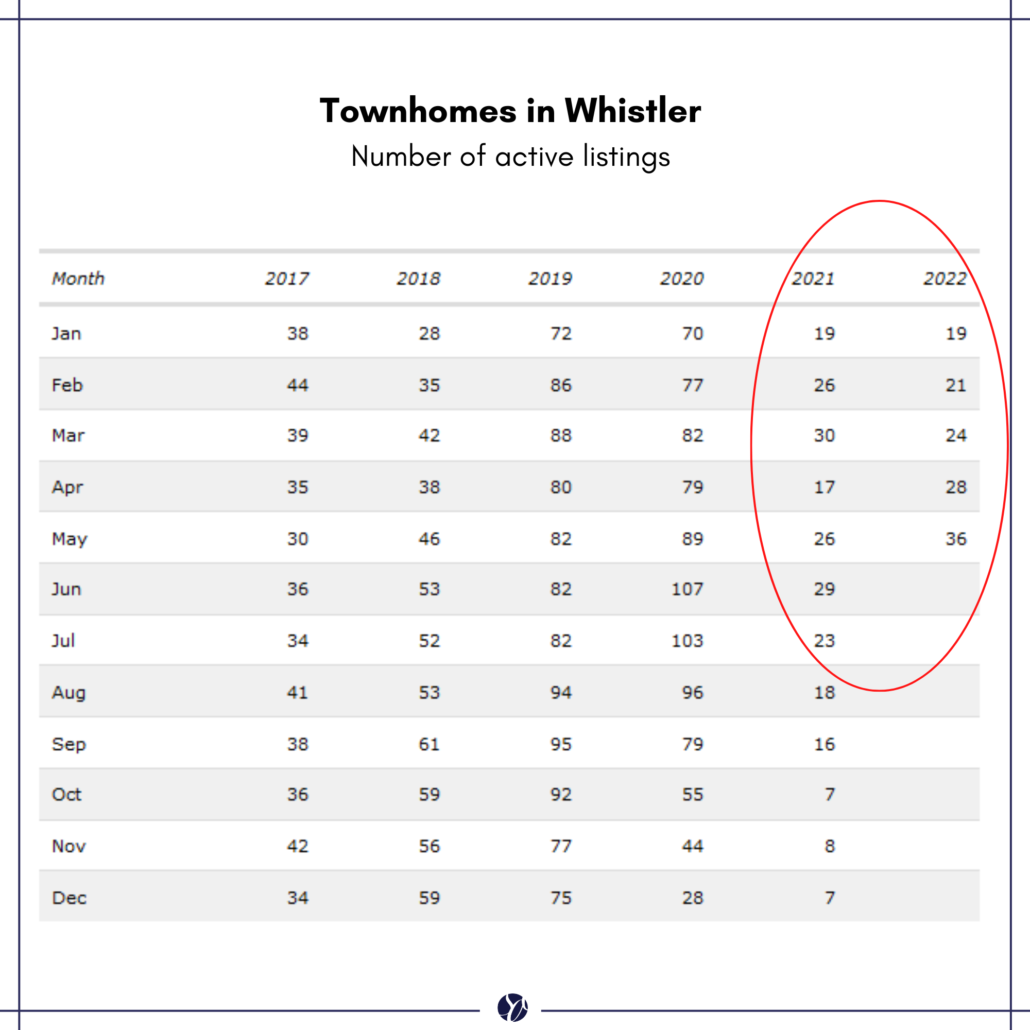

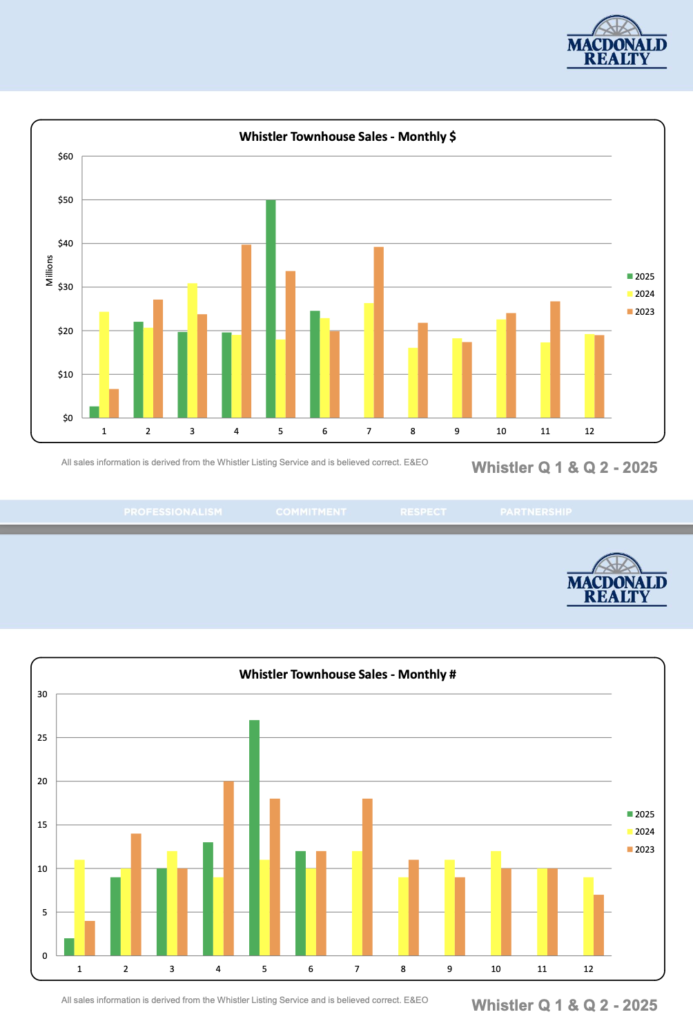

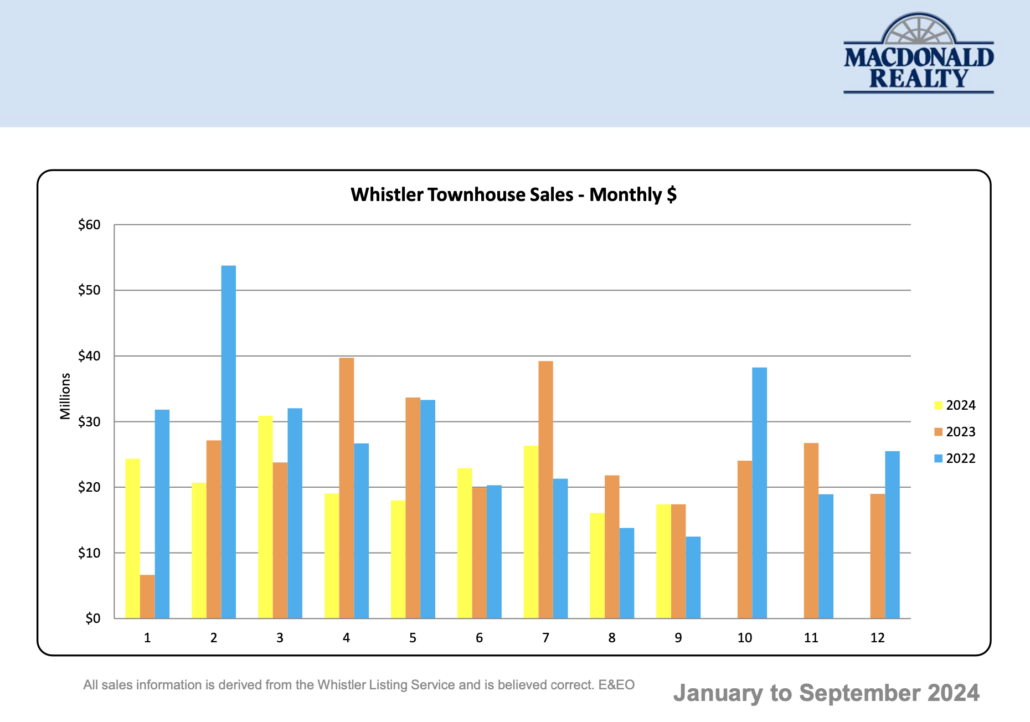

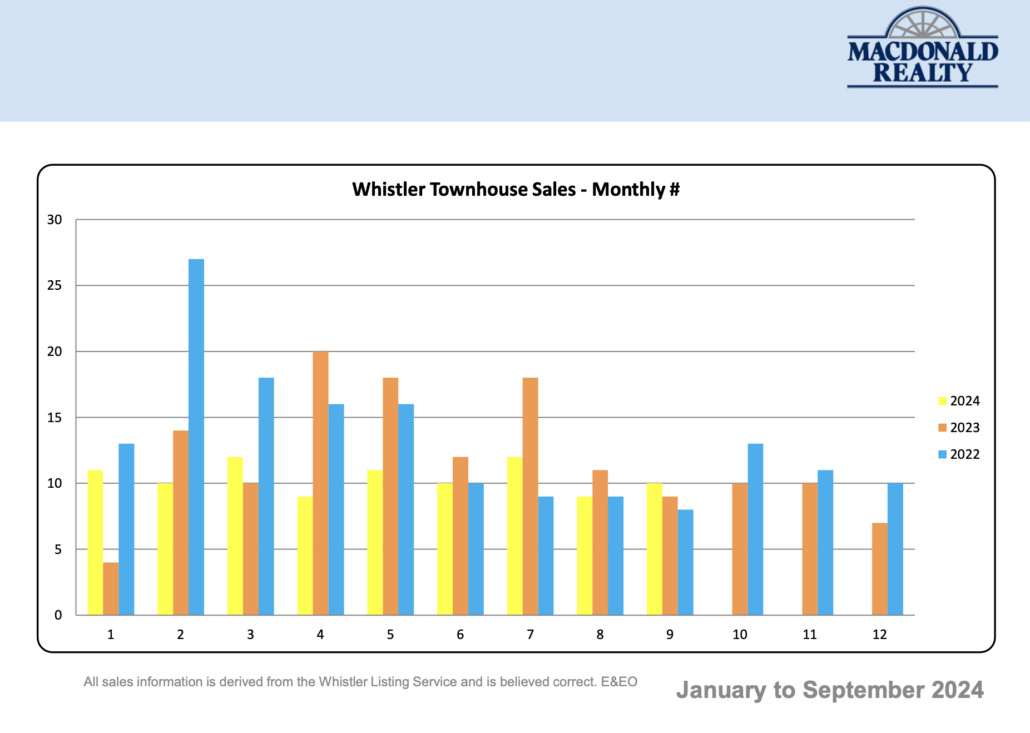

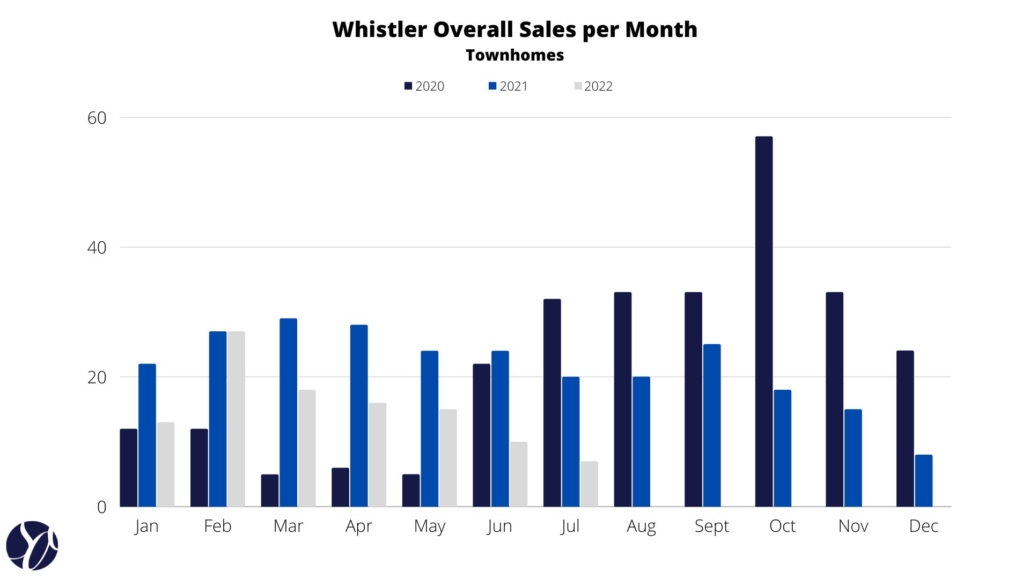

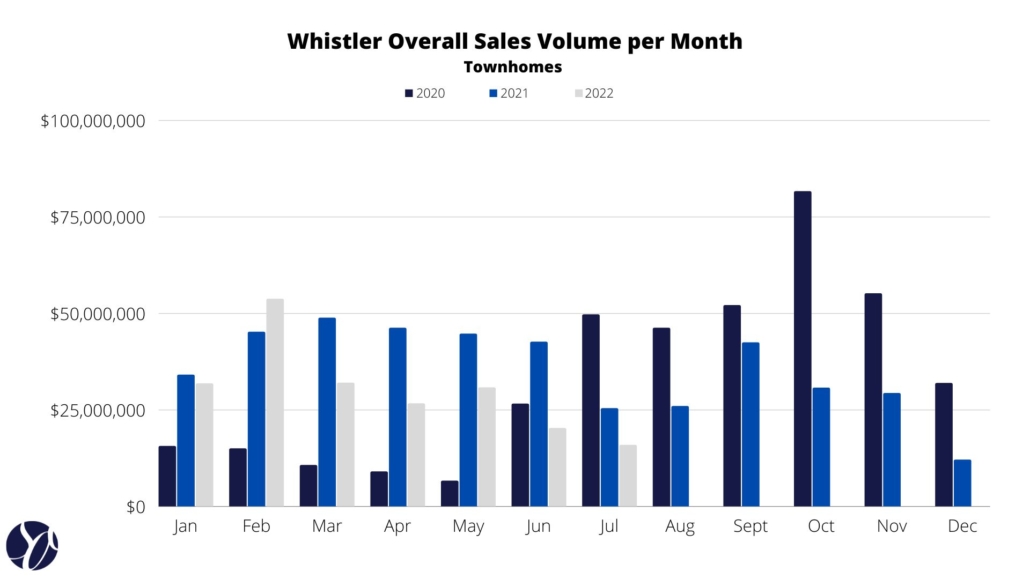

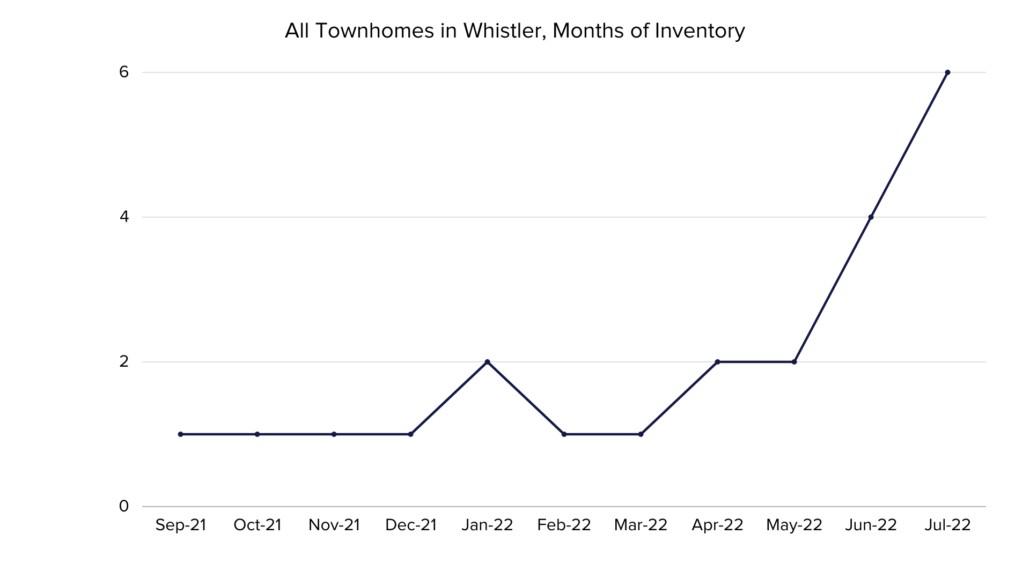

Townhomes

The townhome segment experienced both a dip in sales volume and a lift in pricing — reflecting steady interest among buyers seeking a balance between space and convenience.

There were 35 townhome sales, down 29% from Q2, though still 21% higher than Q3 2024.

The median sale price rose 8% quarter-over-quarter to $1.75 million, while properties averaged 50 days on market, slightly faster than earlier this year.

Inventory decreased by 10%, signaling tightening supply in this ever-popular segment.

📊 Summary: Limited inventory and strong buyer demand continue to support values in this category.

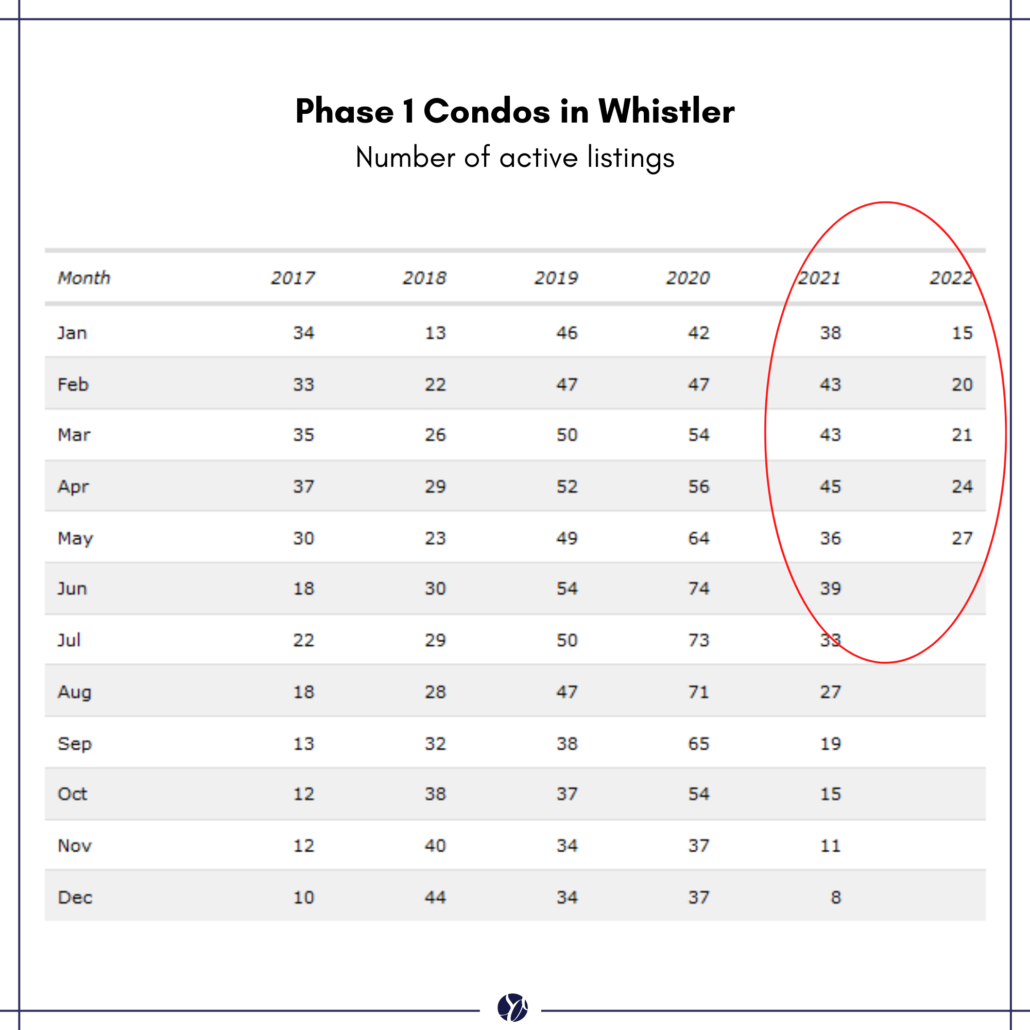

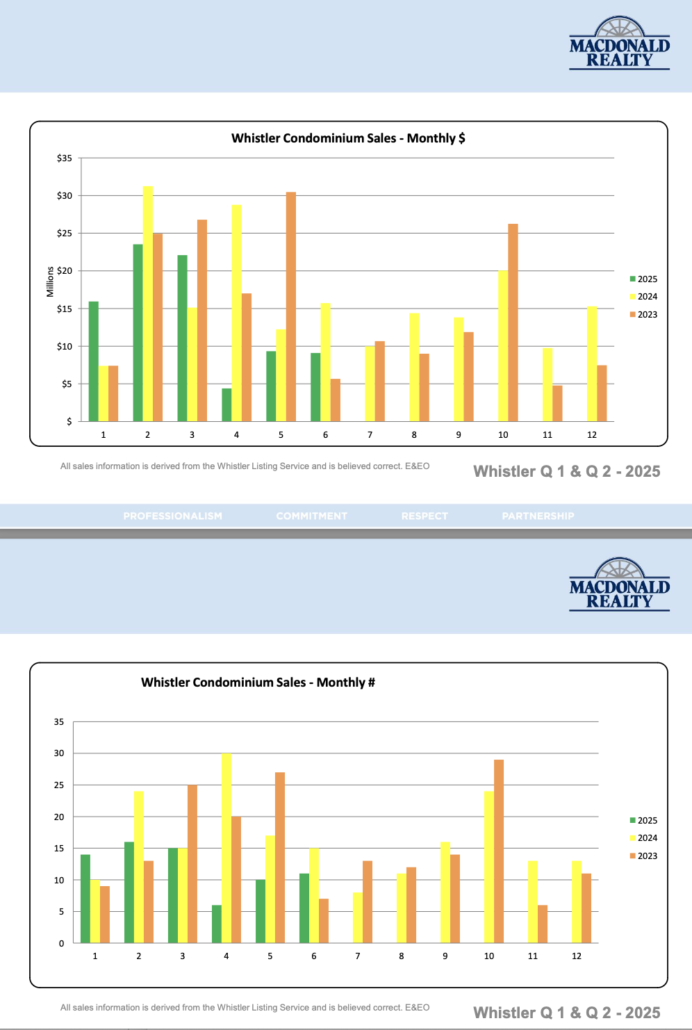

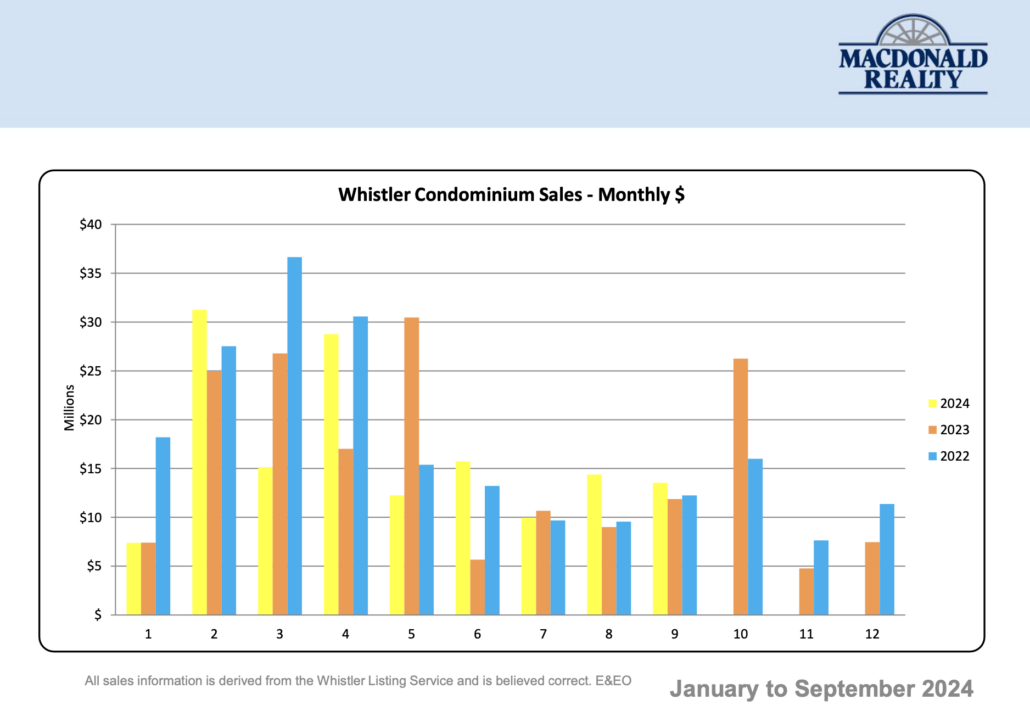

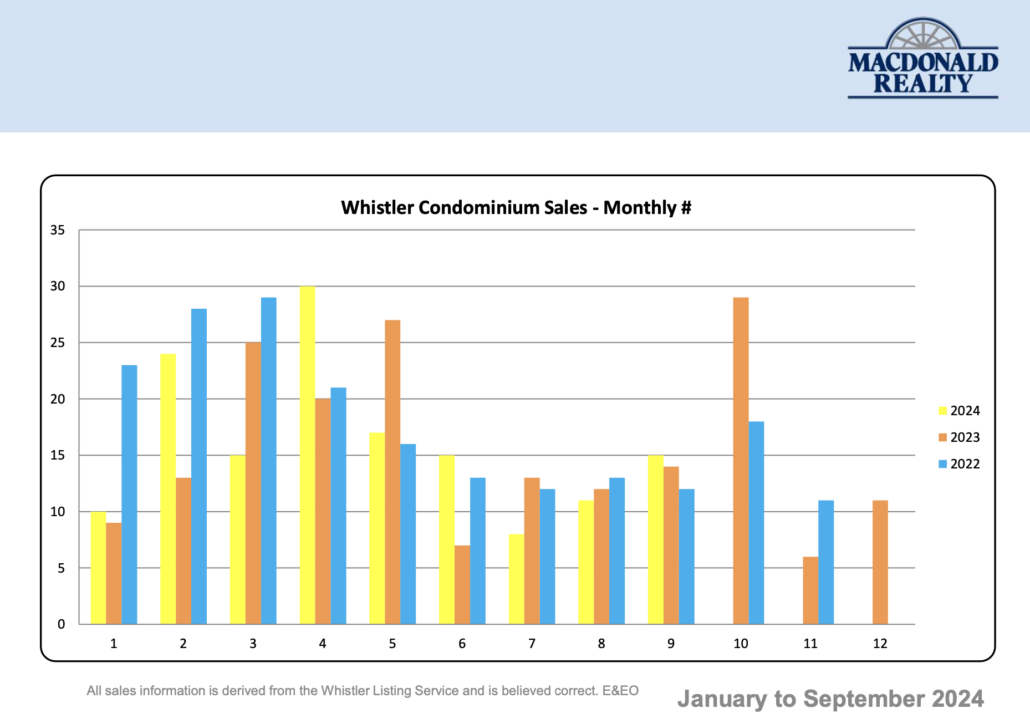

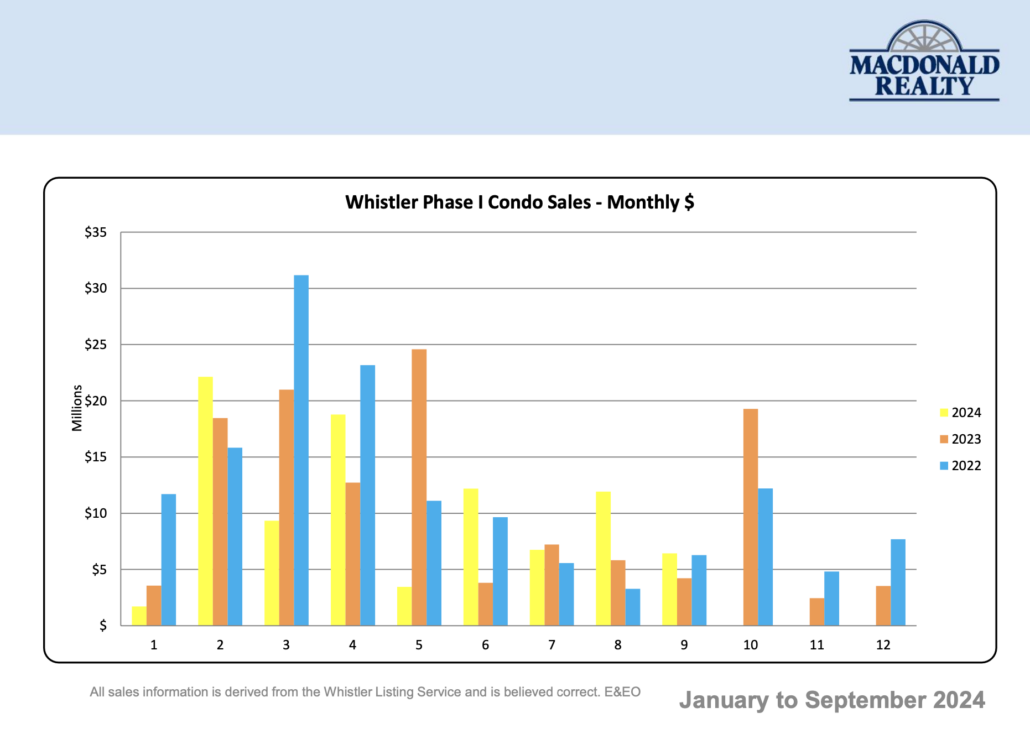

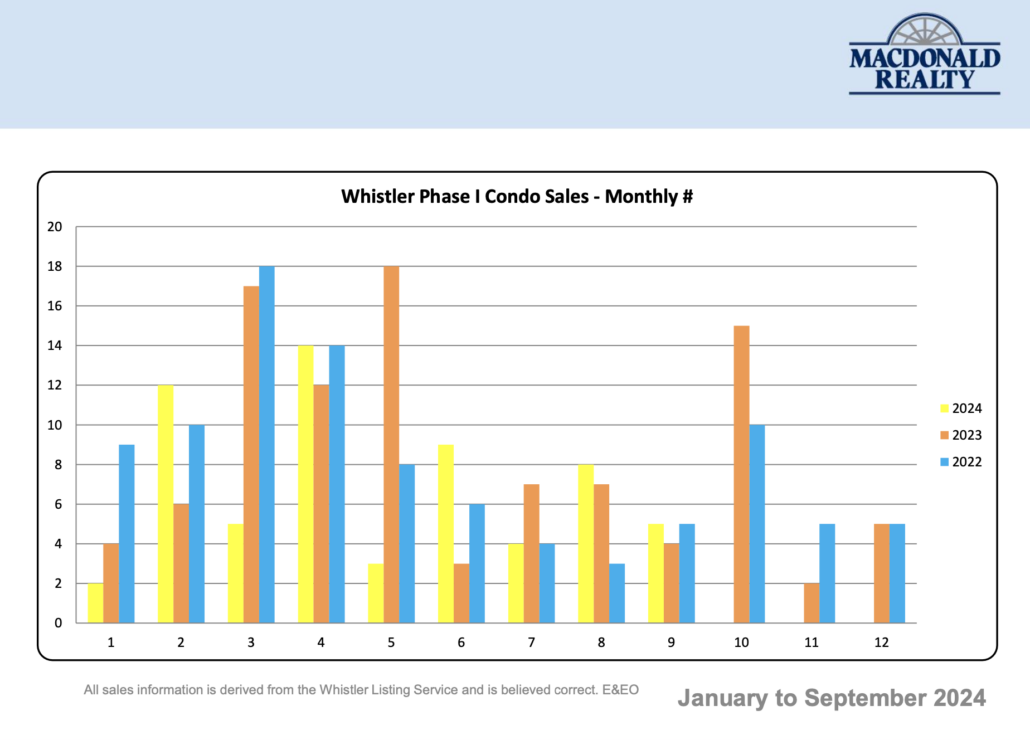

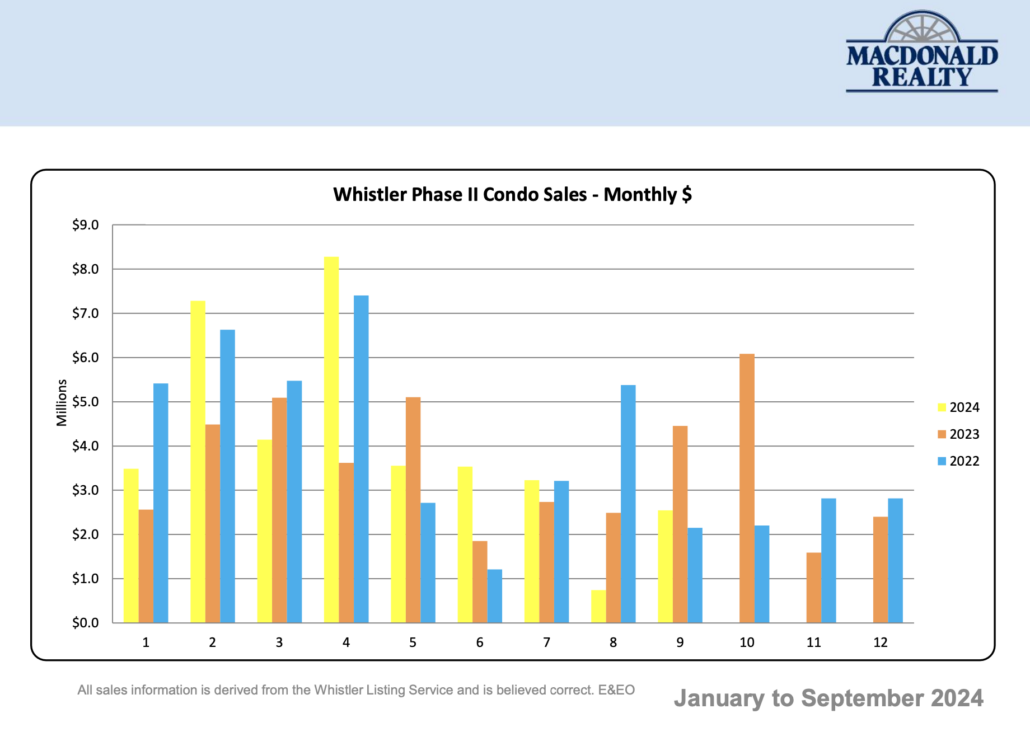

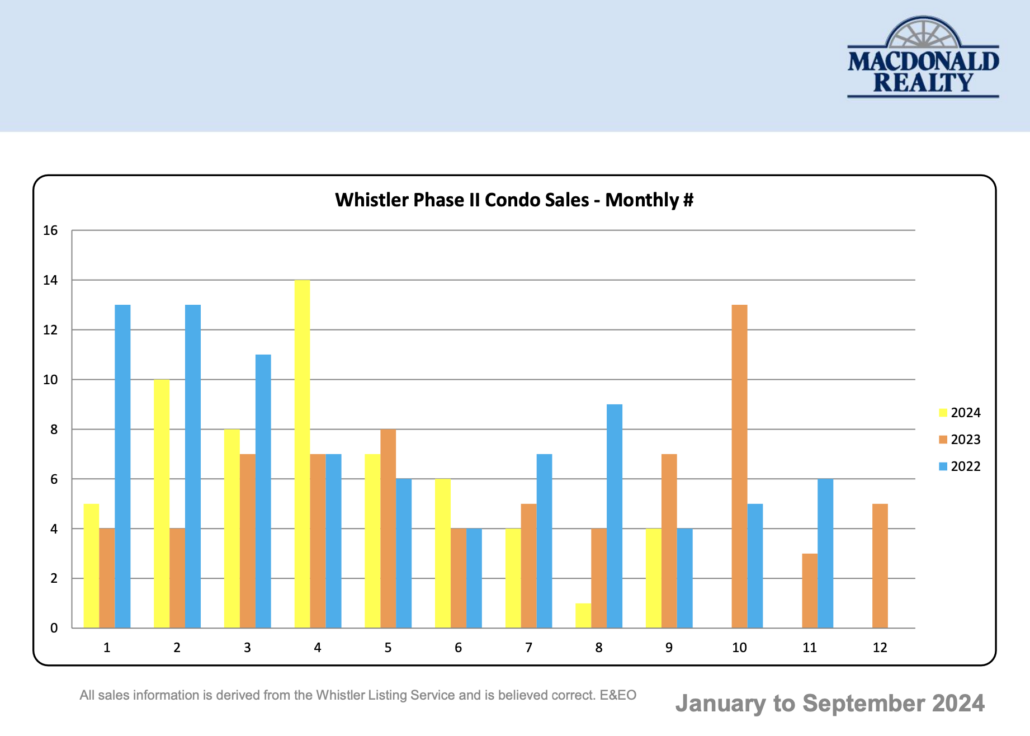

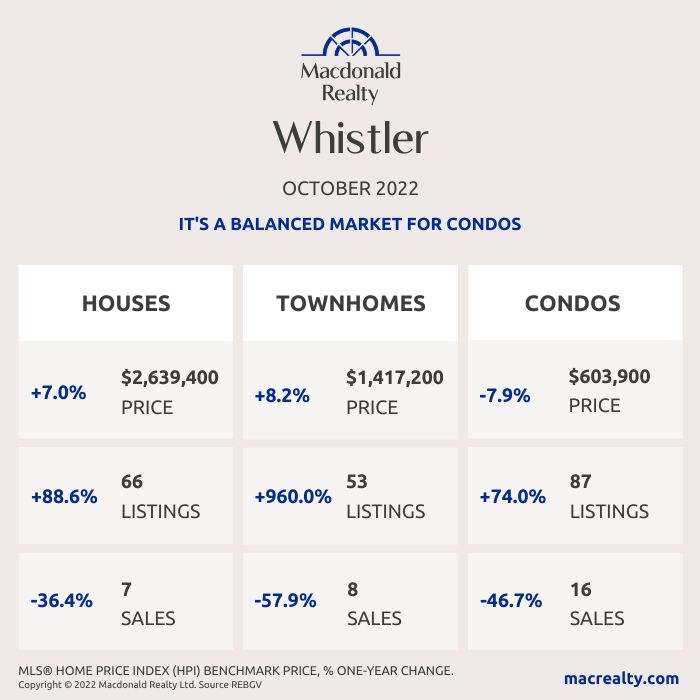

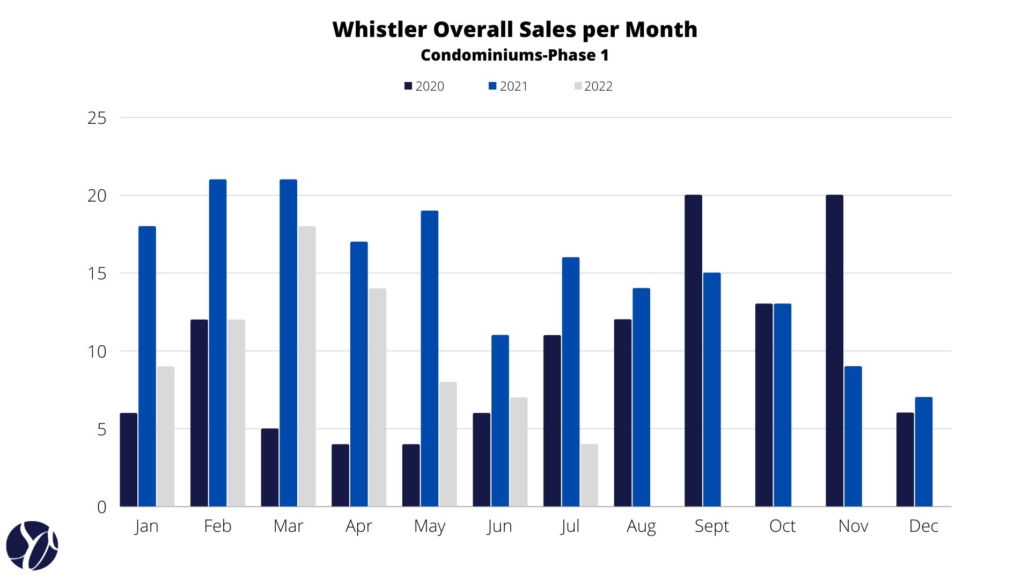

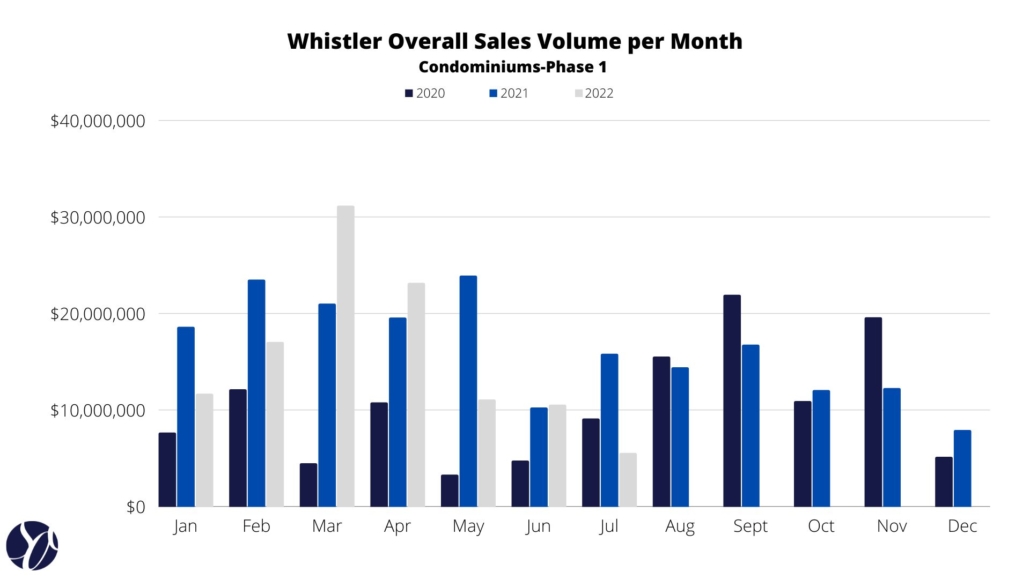

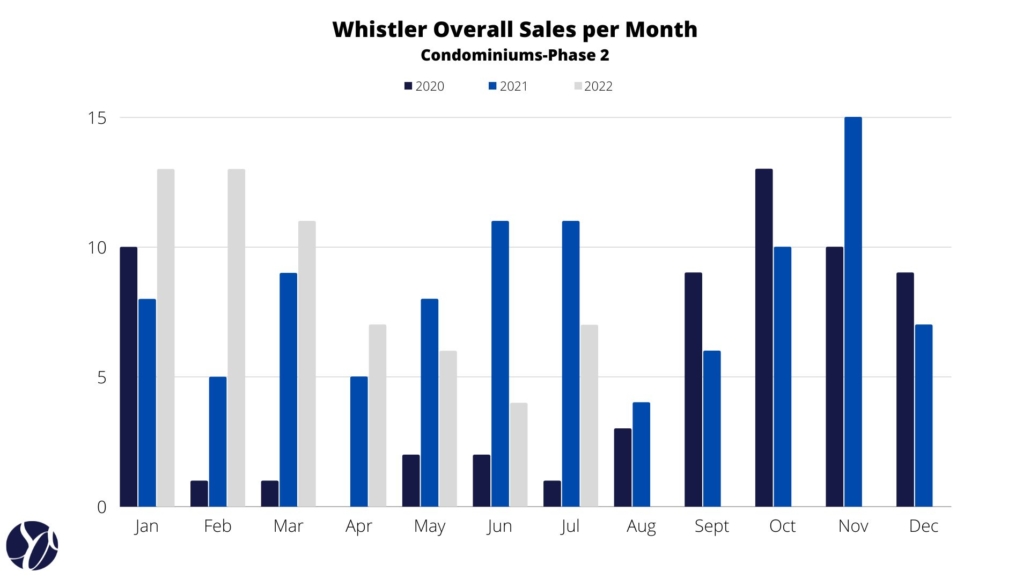

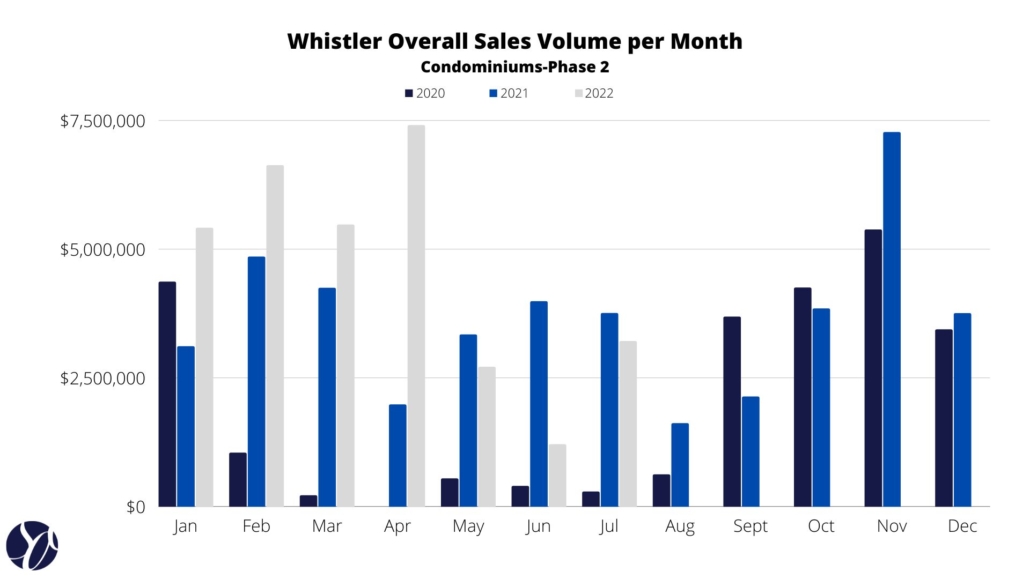

Condos

Whistler’s condo market showed renewed momentum this quarter.

Sales climbed 17% from Q2, with 35 units sold, while the median price increased 6% to $844,000.

Inventory remained healthy at around 100 active listings, down slightly from last quarter but still up 19% year-over-year, giving buyers more choice than in 2024.

Days on market averaged 51 days, relatively stable.

📊 Summary: Condos continue to offer attractive entry points for both personal use and revenue properties.

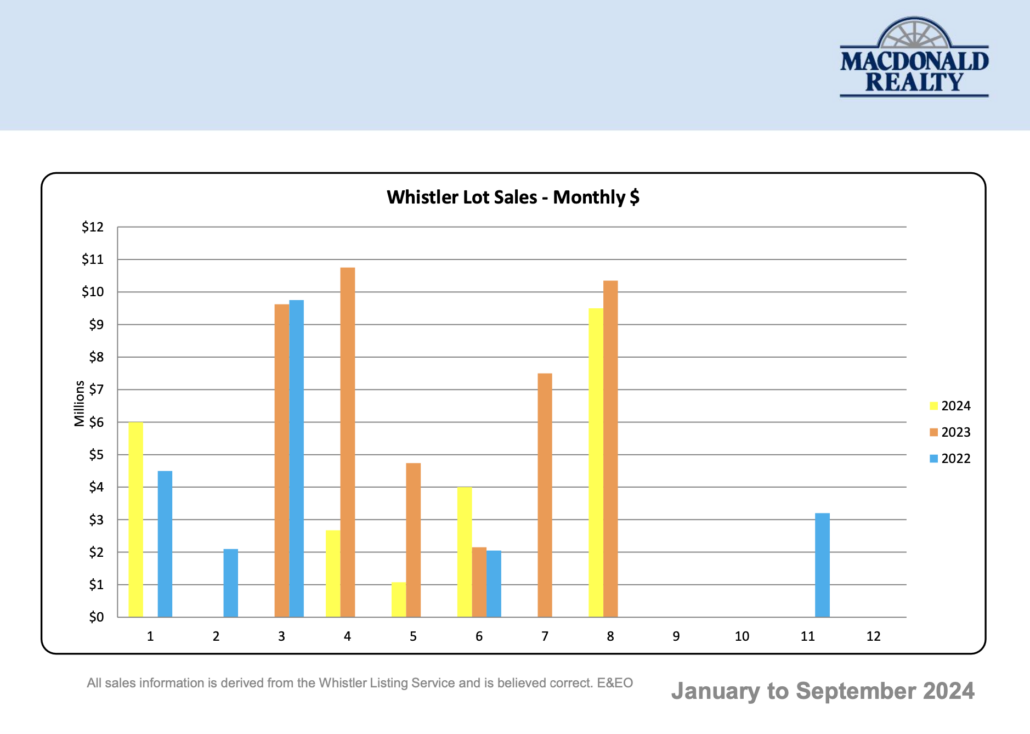

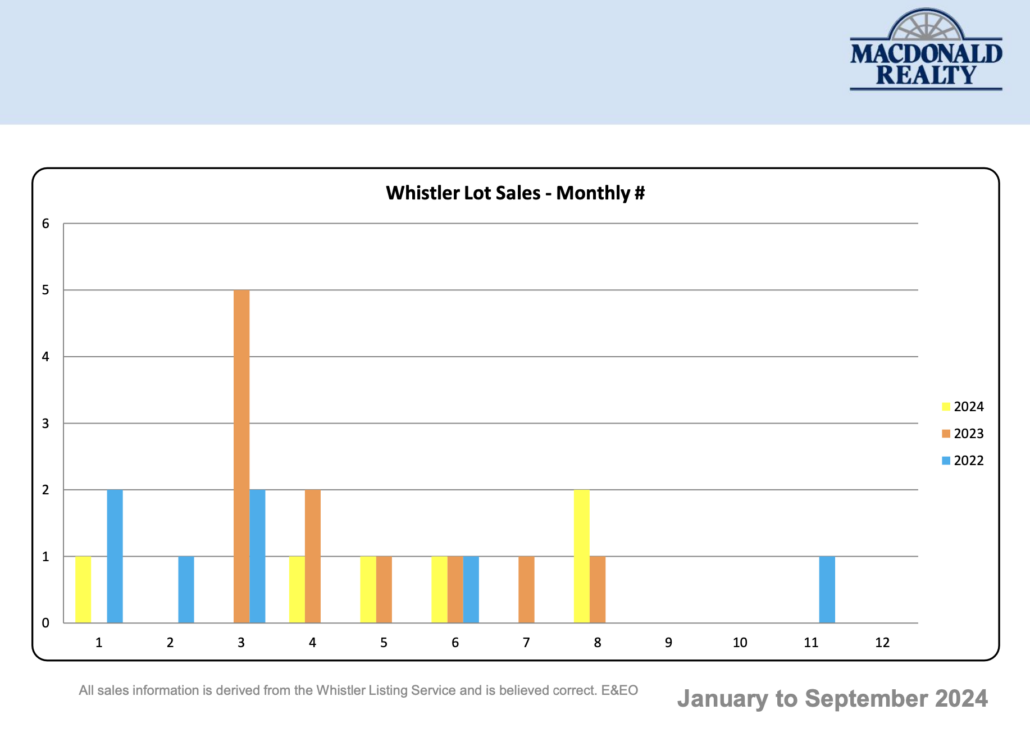

Vacant Land

Land opportunities remain scarce and highly specific, with just one sale in Q3.

Active listings fell 16% from last quarter, and the median sale price was $1.27 million, a 65% decline year-over-year, illustrating limited comparable activity in this niche market.

📊 Summary: The land market is quiet, with minimal turnover and selective buyer interest.

Price Resilience & Market Segments

-

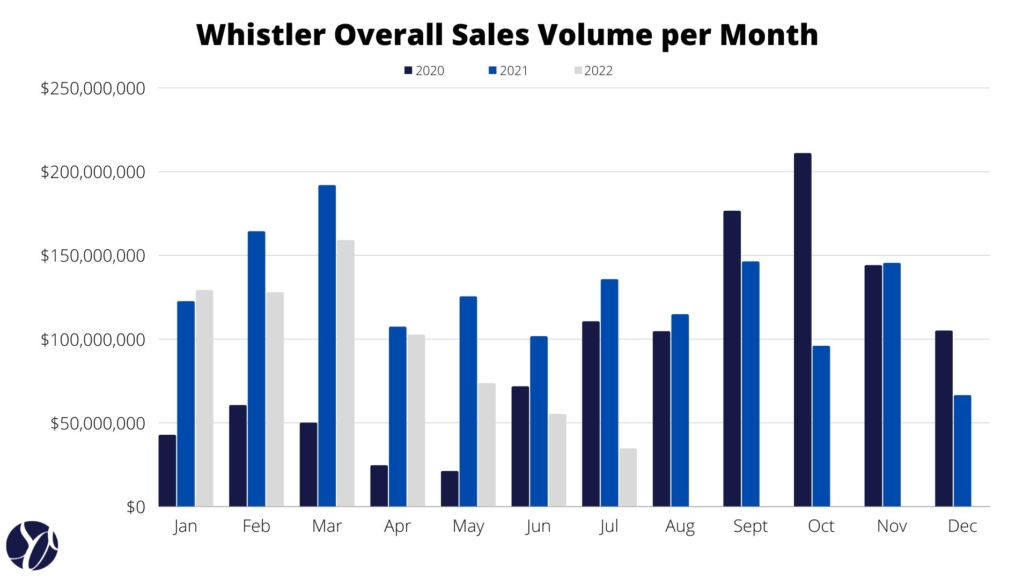

Despite fewer sales, prices held relatively steady across property types — single-family homes, townhomes, and condos all saw pricing anchored compared to year-over-year numbers.

-

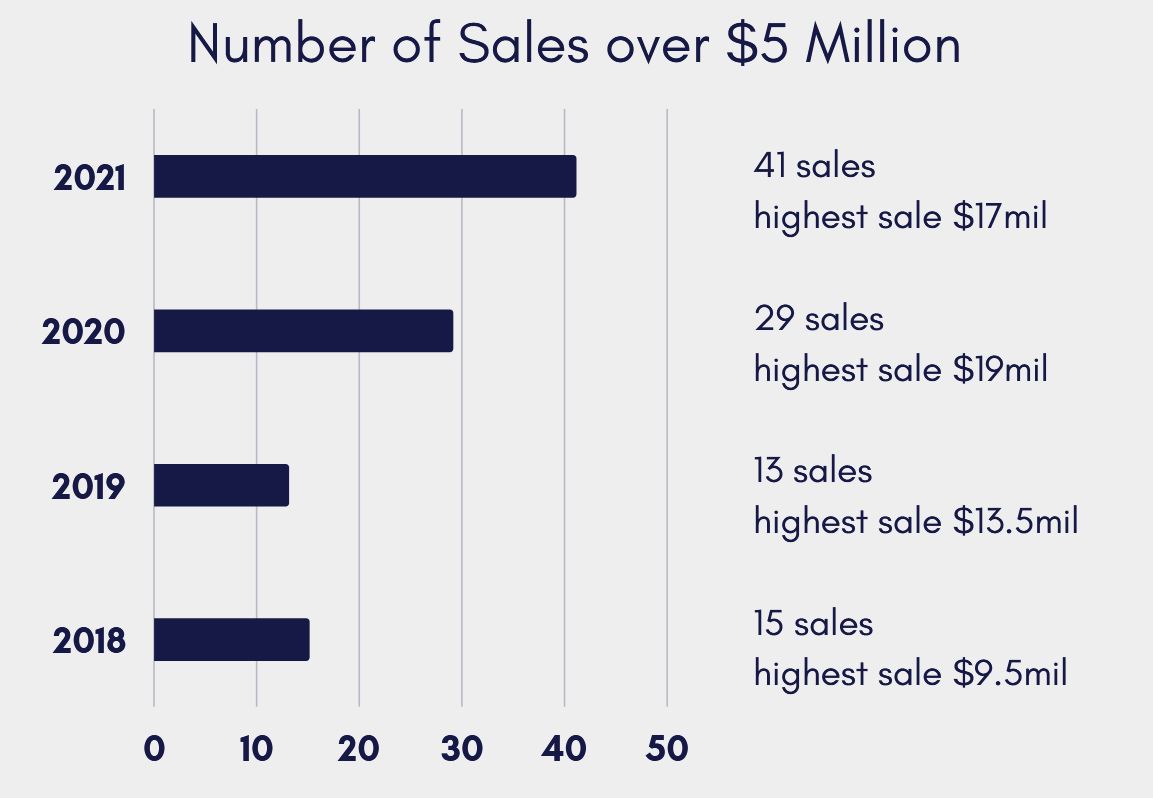

In the luxury sphere, activity remained meaningful: nine sales over $4 million were recorded in Q3, and four of those sold above $5 million, including a standout top sale of $12.65 million.

-

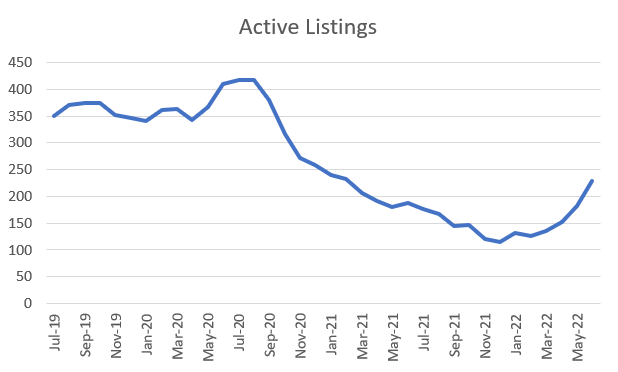

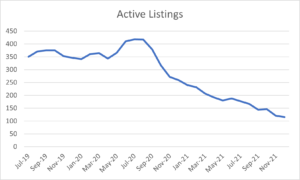

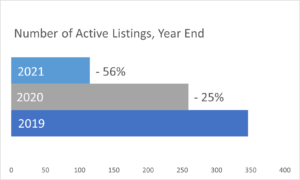

Inventory trends tell a more nuanced story. Overall active listings hovered around 320 units, down about 4% from last year.

-

Townhome inventory declined by around 22%.

-

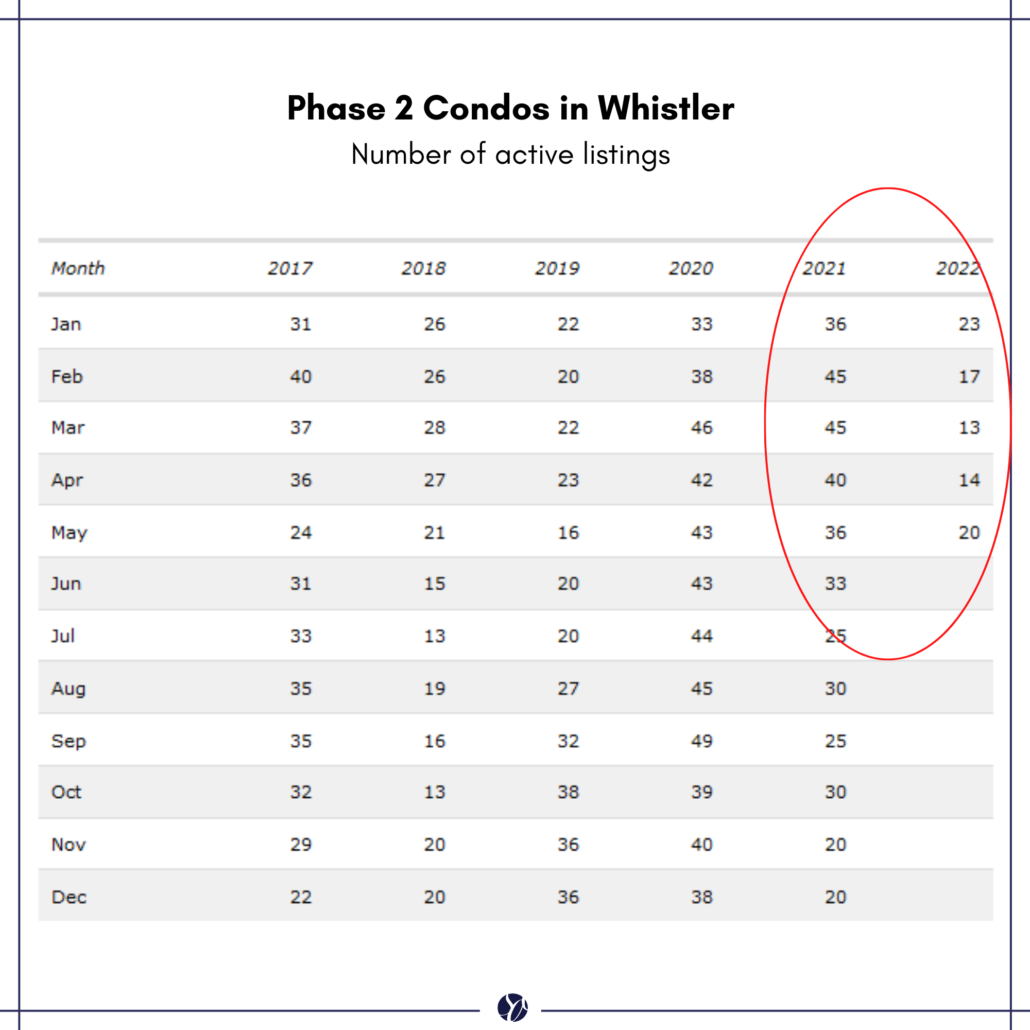

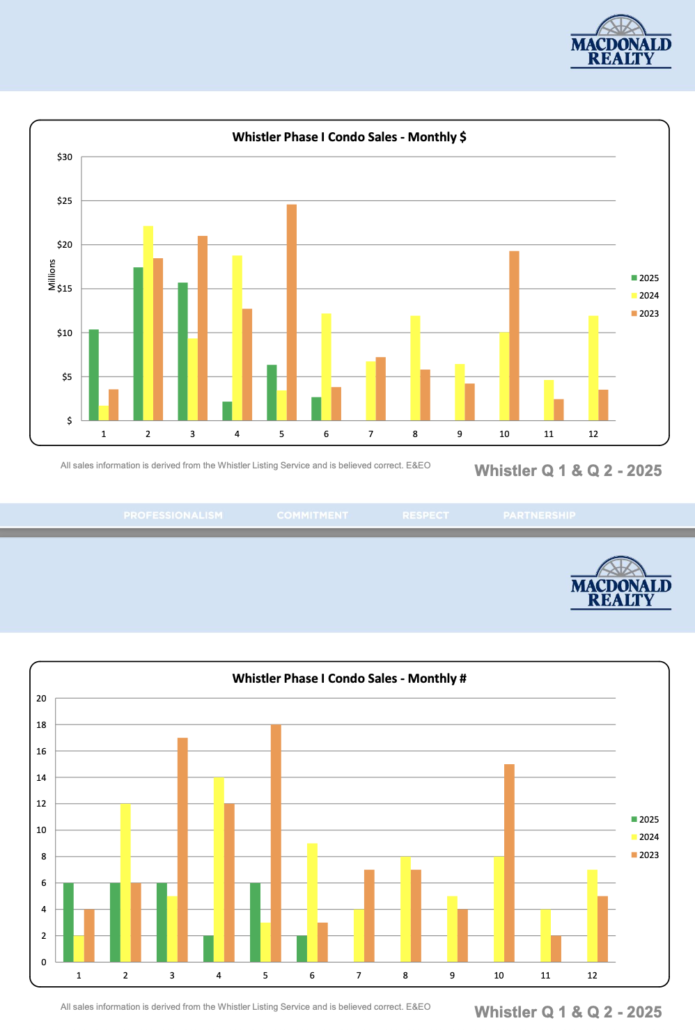

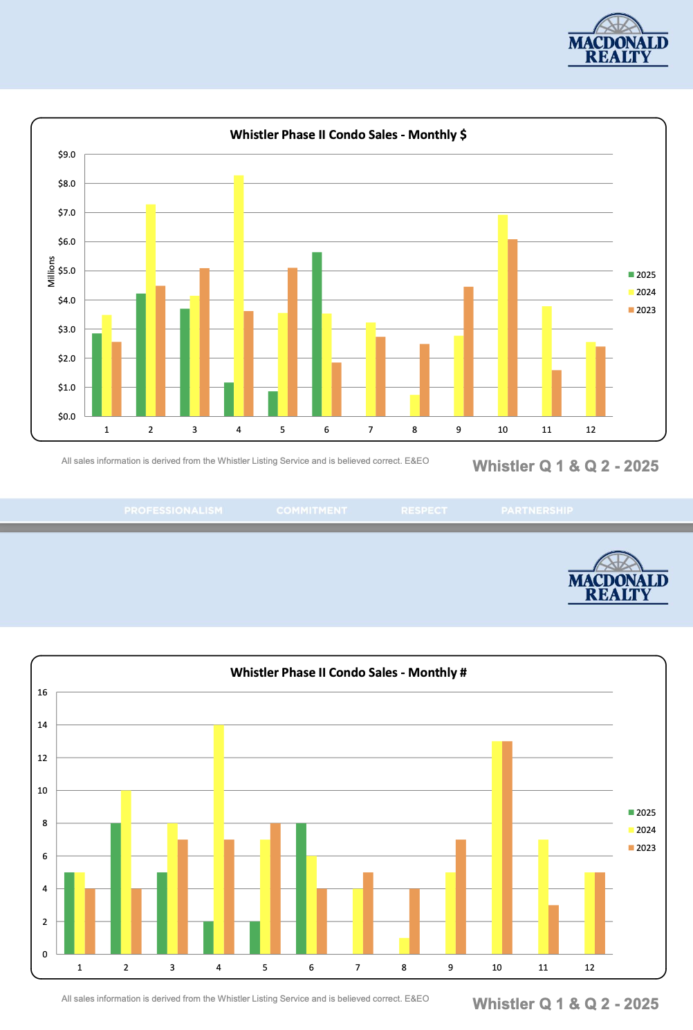

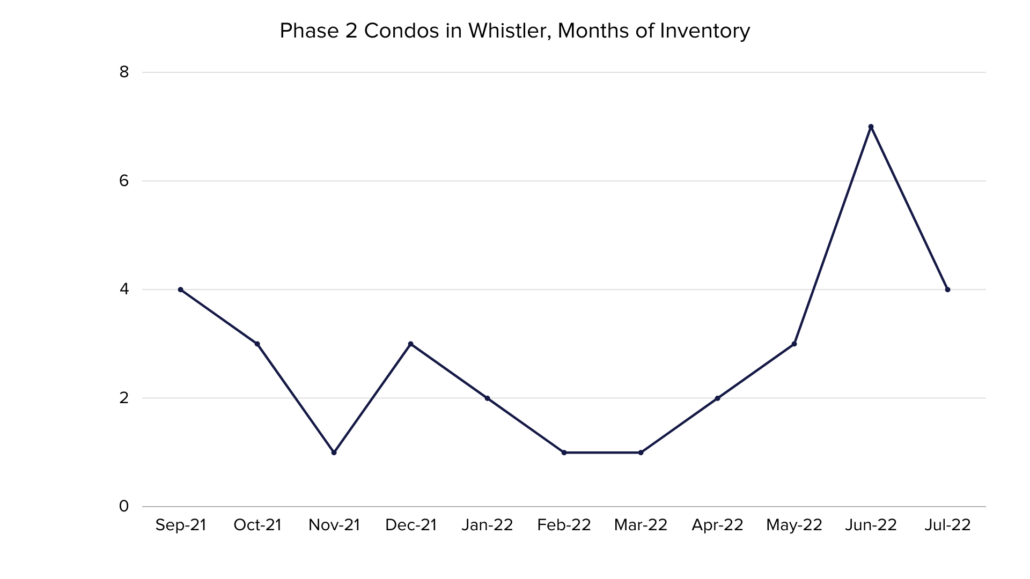

Condo inventory, by contrast, climbed roughly 32%, with Phase 2 hotel-style units nearly doubling in listings.

-

Meanwhile, Phase 1 nightly-rental units also rose, up about 20%.

-

Buyer Origins & Market Composition

-

The origin of buyers remained heavily provincial: 86% from within B.C., exceeding historical averages.

-

8% were U.S. buyers, showing continued international interest in Whistler.

-

Those numbers reinforce that Whistler remains a strong draw for buyers seeking lifestyle, not just investment.

Shauna’s Take

“Whistler’s real estate market has matured into a space where patience and precision pay off. Even in a quieter quarter, well-positioned properties are achieving strong results. For sellers, thoughtful pricing and presentation are key; for buyers, opportunities still exist – especially ahead of ski season.”

Looking Ahead

With ski season just around the corner, Whistler traditionally sees increased market engagement in Q4 as both local and international buyers refocus on mountain living.

Interest rate stability and a steady supply of listings suggest a balanced finish to 2025 — setting the stage for renewed confidence heading into the new year.

The ultimate, indoor winter wonderland experience Wintersphere offers festive activities for the entire family! For a complete Whistler Holiday Guide –

The ultimate, indoor winter wonderland experience Wintersphere offers festive activities for the entire family! For a complete Whistler Holiday Guide –  The slope-side resort will transform into a winter wonderland. Featuring decked halls, twinkling lights and a festive calendar filled with events and activities – there is no better place to celebrate the holidays in Whistler.

The slope-side resort will transform into a winter wonderland. Featuring decked halls, twinkling lights and a festive calendar filled with events and activities – there is no better place to celebrate the holidays in Whistler.

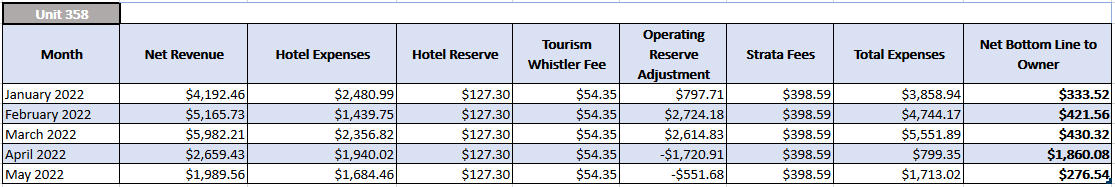

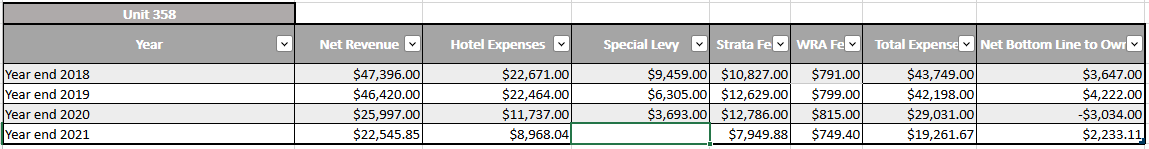

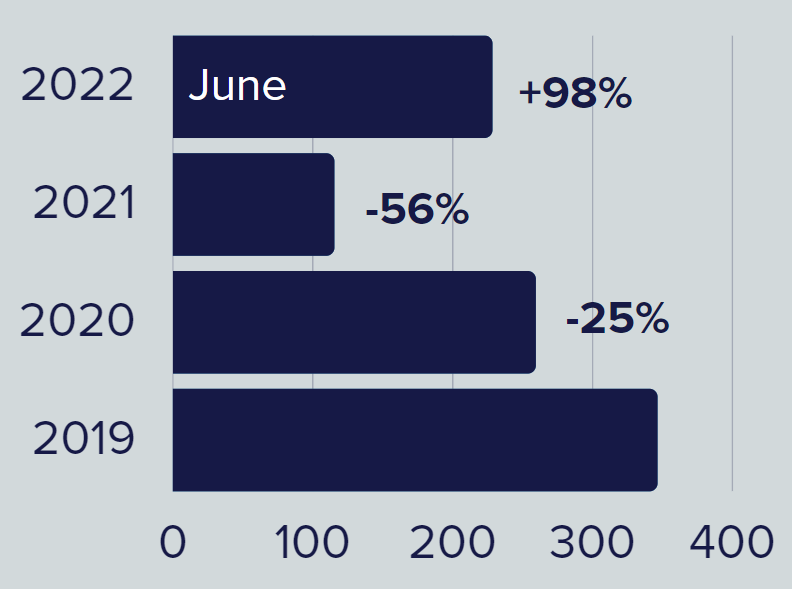

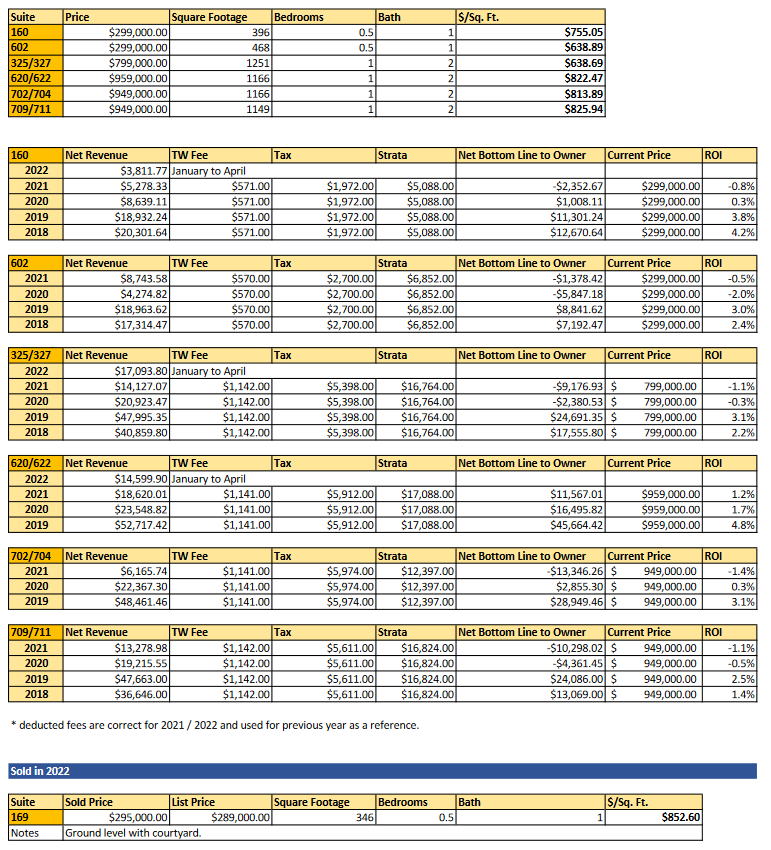

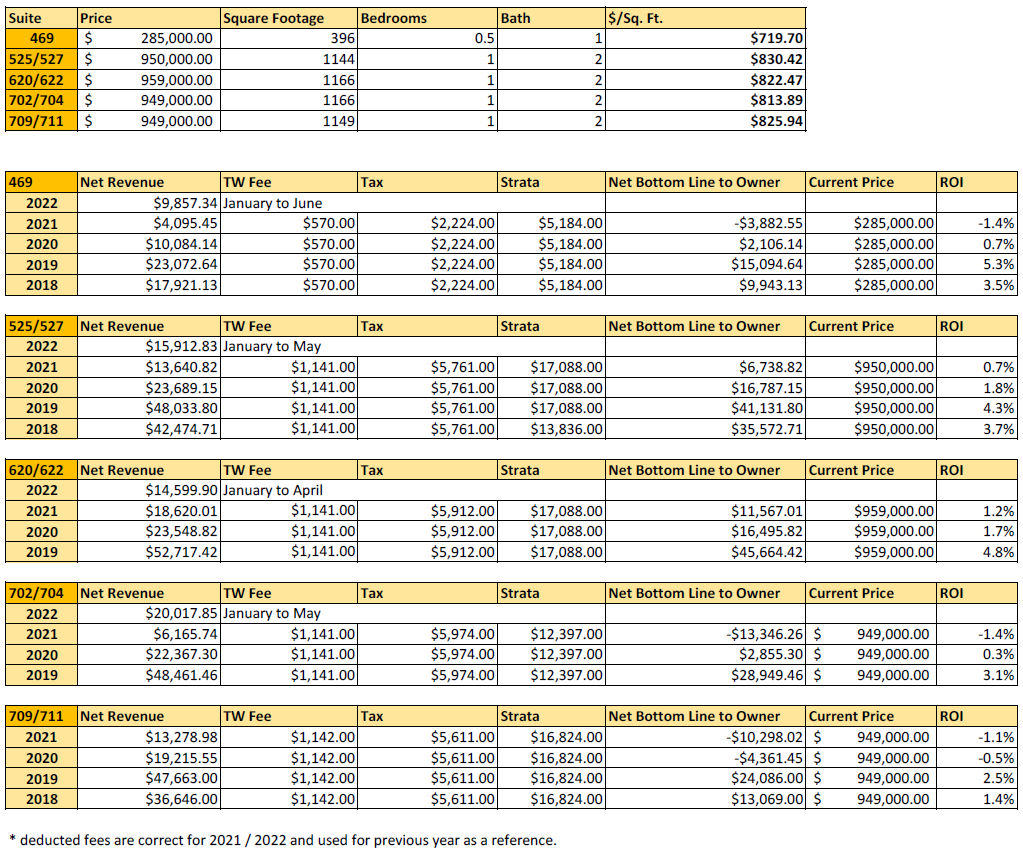

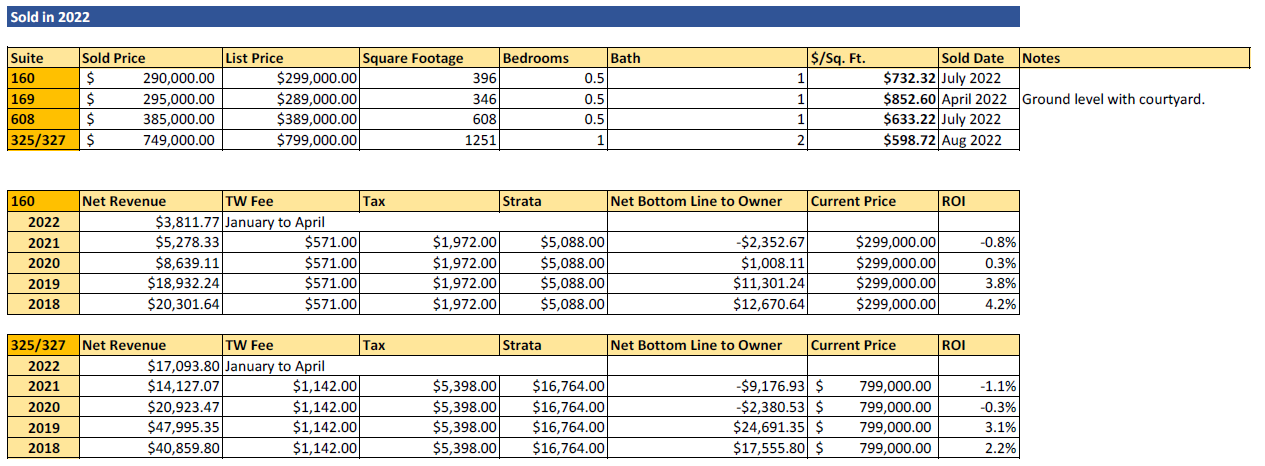

The Hilton Whistler Resort & Spa is a popular investment option for many individuals that are looking to own in Whistler.

The Hilton Whistler Resort & Spa is a popular investment option for many individuals that are looking to own in Whistler.

Combining a ‘walk anywhere’ location in the heart of Whistler Village with warm and friendly service,

Combining a ‘walk anywhere’ location in the heart of Whistler Village with warm and friendly service,