October Newsletter

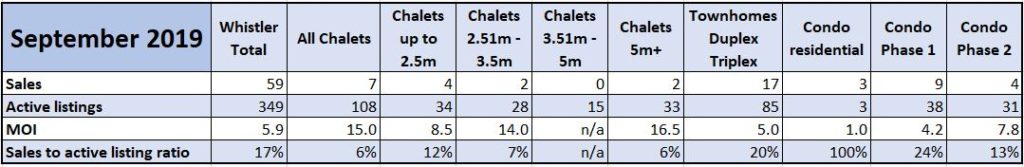

Whistler Real Estate Listings

All Chalets for sale in Whistler

All Townhomes for sale Whistler

Residential & Phase 1 Condos for sale in Whistler

Phase 2 properties for sale in Whistler

Will you be in Whistler for Canadian Thanksgiving?

Please let us know if you will be in Whistler for Canadian Thanksgiving (14th October) this year. We will send you a short survey a bit closer to the date to see where we can find you to say Thanks.

Please let us know if you will be in Whistler for Canadian Thanksgiving (14th October) this year. We will send you a short survey a bit closer to the date to see where we can find you to say Thanks.

Four Seasons Resort Whistler Debuts Modern Look – The Mountain Lodge, Reimagined

Nestled at the base of Whistler Blackcomb ski resort, framed by evergreen forests, Four Seasons Resort Whistler presents a newly-updated take on the classic mountain lodge. Inspired by this remarkable setting, the modern renovations embrace the spirit of discovery ever-present at Four Seasons Resort Whistler. Backing each design choice is the dedication to creating a truly one-of-a-kind experience, one that exceeds all expectations. Each new feature and offering is a fresh opportunity to disconnect from the everyday and reconnect with the extraordinary – along the way, creating a mountain of memories.

Nestled at the base of Whistler Blackcomb ski resort, framed by evergreen forests, Four Seasons Resort Whistler presents a newly-updated take on the classic mountain lodge. Inspired by this remarkable setting, the modern renovations embrace the spirit of discovery ever-present at Four Seasons Resort Whistler. Backing each design choice is the dedication to creating a truly one-of-a-kind experience, one that exceeds all expectations. Each new feature and offering is a fresh opportunity to disconnect from the everyday and reconnect with the extraordinary – along the way, creating a mountain of memories.

After renovations that began in the spring of 2019, the Resort debuts the property’s 273 rooms and suites in anticipation of the 2019/2020 ski season. Nodding to the mountain’s globetrotting guests, Four Seasons Resort Whistler blends modern interiors with alpine style, to offer a truly memorable experience at one of Canada’s most iconic destinations. Read more and see the pictures…

Want to own in the Four Seasons?

Have a look at this fantastic listing:

2 bed, 2 bath, 1,445 sq suite with a flexible floor plan with a lock off option.

BC Housing Affordability

Please consider this impact to our real estate market in Whistler when casting your vote. We need a party that will consider the stress test and the impact on our market especially because any other government affordability peaks or programs won’t apply to Whistler. We need financing for the workers of Whistler (locals), small business owners and hard working people who have Whistler as their weekend home. Whistler does not need to be handicapped with the added burden and costs of financing especially in such an expensive market. We have many clients who cant sell of buy, downsize or renew financing due to no longer qualifying under the new rules.

BC Housing Sector Urges Federal Parties to Act on Affordability Recommendations

Too many British Columbians struggle to find an affordable home to rent or own because of a lack of housing options. Nearly six in ten uncommitted Canadian voters cite access to affordable housing as a top election issue, according to an August 2019 Angus Reid survey.

The next federal government has the opportunity to improve affordability by reducing taxes on new rental homes, encouraging housing supply to match transit targets and changing mortgage underwriting rules.

Six organizations representing the BC housing sector have partnered to make housing affordability recommendations that focus on much-needed solutions. In advance of the first debate, we urge each of the parties to adopt the following recommendations to help address the housing and affordability challenges in British Columbia and the rest of Canada. Here is one which in my opinion is very important for Whistler and local housing.

Adjust the mortgage stress test and amortization rules

In 2018, the federal government enacted new mortgage rules that require borrowers to qualify for a mortgage at the higher of either the rate they’ve negotiated with their bank plus two per cent or the Bank of Canada’s five-year rate. This B-20 stress test has had a pronounced impact in BC, causing an estimated $500 million in lost economic activity.

The B-20 stress test should be a flexible policy that is adjusted regularly to respond to economic trends.

B-20 is now due for an adjustment for the following reasons:

- the debt burden has increased for people unable to access conventional financing who must resort to more expensive alternative mortgage financing,

- personal incomes nationally have risen by 12.5 per cent over the last five years, and

- a borrower’s equity position increases throughout the term of a mortgage due to principal payments.

Changing the stress test would help achieve the government’s goal of ensuring Canadians don’t take on more debt than they can bear, while acknowledging ongoing economic trends.

We recommend:

- reinstating 30-year amortizations for insured mortgages to make monthly payments more manageable,

- qualifying all borrowers at their contracted amortization period (e.g., 30 years) instead of a 25-year period, and

- excluding the stress test for mortgage transfers and switches, which better enables borrowers to shop for competitive mortgage terms at renewal time, and

- employing flexible stress tests that reflect the level of risk posed by the terms and conditions of the particular mortgage, including amortization period, fixed vs. variable rate and how interest rates are forecasted to change over the term of the loan.

For a PDF of the news release, click here.

To learn more, visit bchousingaffordability.ca.