New Foreign Buyer Tax for Greater Vancouver

Yesterday, the provincial government announced that they will implement a 15 per cent foreign buyer tax on all residential transactions in Greater Vancouver effective August 2, 2016.

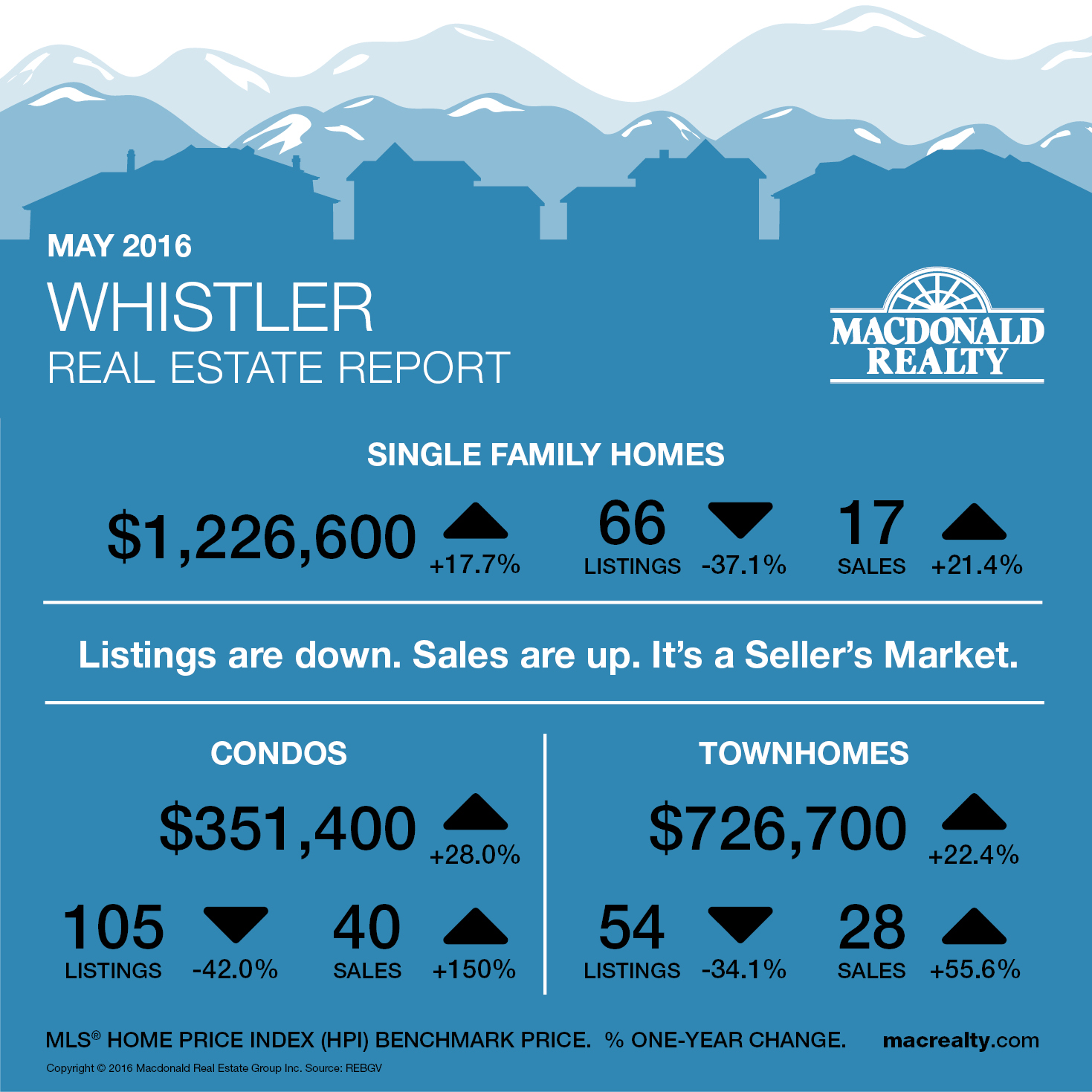

We have a received numerous inquiries and questions about this new tax and would like to pass on the below information and clarify that the tax does not apply in Whistler. It only affects properties in the Greater Vancouver area purchased by foreign nationals. Below is the news release from the Real Estate Board of Greater Vancouver.

Real Estate Board of Greater Vancouver – Press Release

Government to introduce a 15 per cent foreign buyer tax effective August 2

The provincial government will implement a 15 per cent foreign buyer tax on all residential transactions effective August 2, 2016. The tax will be added to the Property Transfer Tax and will apply to all residential properties purchased by foreign nationals or foreign-controlled corporations.

The new tax will be payable on applicable transfers registered with the Land Title Office on or after August 2 regardless of when the deal was completed.

The tax will apply to any transferee that is a foreign national, foreign corporation, or taxable trustee. Foreign nationals are defined as people who aren’t Canadian citizens or don’t have permanent resident status in Canada. (Permanent residents will have a valid permanent resident card issued by the Canadian government.)

“Housing affordability concerns all of us who live in the region. Implementing a new real estate tax, however, with just eight days’ notice and no consultation with the professionals who serve home buyers and sellers every day needlessly injects uncertainty into the market,” Dan Morrison, Board president said. “Government has had a long time to take action on the affordability issue, yet they decide to bring this new tax in over a long weekend, with no notice, and no time to prepare. It would have been prudent to seek consultation from the people most knowledgeable about the impact.”

Under the new tax, for example, a foreign buyer or foreign-controlled entity will pay an additional $300,000 in tax on a $2 million home.

“To minimize short-term volatility in the market, we’re calling on government to exempt real estate transactions that are in the process of closing from this new tax,” Morrison said.

Foreign corporations are any corporation not incorporated in Canada, or are incorporated in Canada but controlled in part, or wholly, by a foreign national or corporation. Publicly traded companies are excluded.

Commercial properties are excluded, and mixed-use properties will only pay the tax on the portion of the property’s value that’s for residential use.

For more information:

Read the government announcement here.

Read the government’s tax information sheet here.

We’ll continue to share information with you on this development as we learn more.