Foreign money boosts recreational property market

The foreign-buying frenzy in Vancouver isn’t only driving up prices there, but that overseas cash is now funding a buying spree for retirement and vacation properties in other parts of the province, according to one expert.

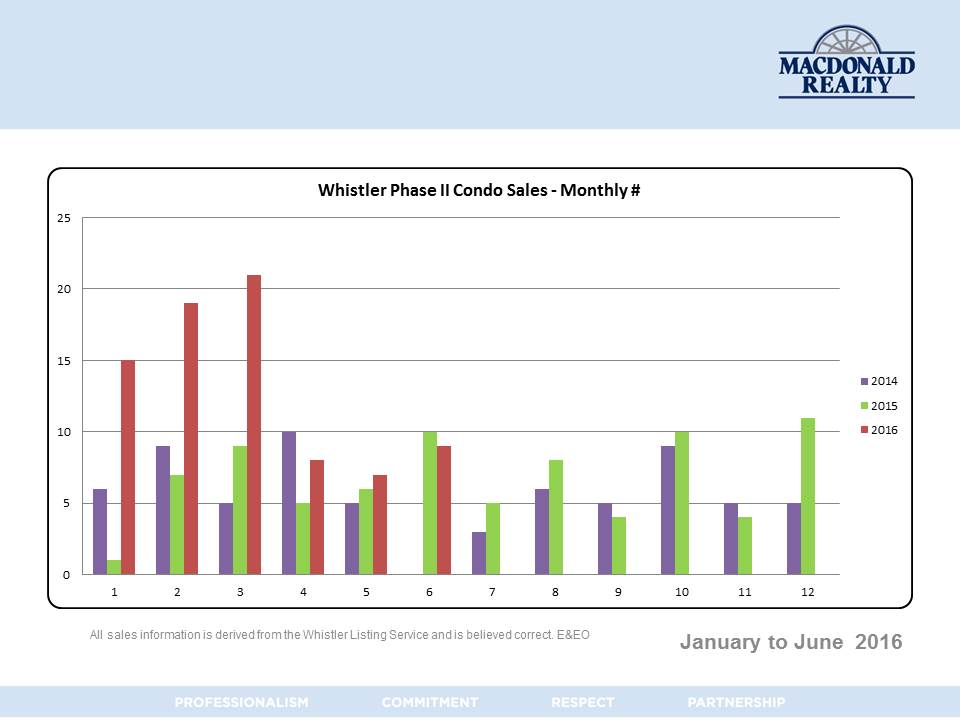

“In Whistler we’re seeing a lot of people cash out from Vancouver in the single-family home sector because they’re getting big Chinese money for their home in Point Grey or Kitsilano and they’re coming up here and finally getting to live the dream,” Shauna O’Callaghan, an agent with Macdonald Realty Inc., told CREW.

The low Canadian dollar is also driving investors into the area, though these ones are travelling shorter distances to buy.

“We see U.S. investment and the market that I see influencing Whistler is Washington,” says O’Callaghan, who holds a Certified Luxury Market Specialist (CLHMS) designation. “It’s not just the dollar spurring this trend, but the strength of their economy, driven largely by the tech industry.”

Other industry leaders point to recreational properties in the eastern part of the province benefitting from the downturn in Alberta. Central 1 Credit Union recently reported that weaker conditions have helped increase interprovincial migration to 3,500 people a quarter this year.

Many of these newcomers have received “generous buyout” packages which have allowed Alberta buyers to retire early.

The Whistler market has grown tighter for investors since the 2010 Winter Olympics and according to O’Callaghan most of the supply has now been absorbed.

“As a result of that is we’re seeing prices increase and it’s just become harder for people to find what they’re looking for,” she says.

That’s why she urges potential buyers to get in while they can.

“Down the road, some people are going to kick themselves that they didn’t buy now. They’ve been spoiled thinking that this is a quiet market, but that’s changed. There are multiple offer situations and they’re going to have to compromise on what they want because we just don’t have the inventory.”

Published, 28 Oct 2015, Canadian Real Estate Wealth