What’s available?

Follow the links to the wonderful properties that are on the market

Luxury Estates

Cheap and Cheerful Whistler Shacks

Village Blackcomb and Creekside – Properties you can rent yourself

Hotel Investment Properties aka. Phase Two

Shared Ownership

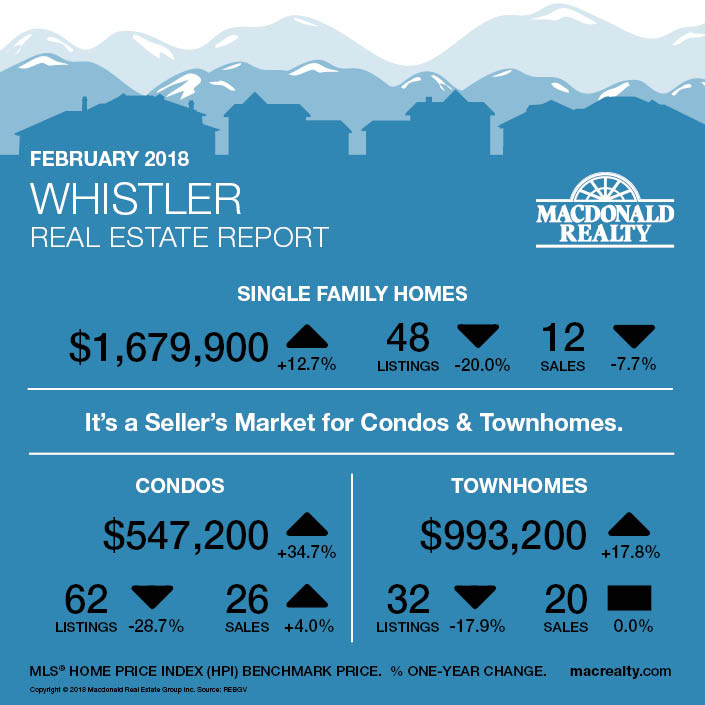

Whistler Market Update – February 2018

The report below shows benchmark prices for properties in Whistler. If you would like to learn more about benchmark prices, follow this link for some great information.

This is what you have been reading about… in a nutshell.

The past few years have seen unprecedented change in the BC real estate industry. While price inflation has been the big story, there have also been rapid shifts in market preferences, intense competition within the industry, concerns about eroding professional standards resulting in the introduction of a new regulatory regime, and changes in government policies that have all presented major challenges. Moreover, the trend toward rapid change is likely to continue in 2018.

Where the market is heading is anyone’s guess, and the uncertainty is greater than ever, with strong forces working both for and against continued price escalation.

Headwinds keeping prices in check include:

However, tailwinds, possibly more forceful than the headwinds, include:

Interestingly, while the strongest headwinds are driven by BC government policy, so are some of the more pronounced tailwinds, such as the policies of encouraging tourism and promoting the province as a destination for foreign students. Moreover, Federal government immigration programs, ostensibly aimed at economic development in other provinces, in fact drive billions of dollars annually into BC’s residential real estate market. In the realm of policy, it is possible that Federal policies will overwhelm anything done at the Provincial or Municipal levels. And, of course, the most forceful tailwinds are still being generated by pure economic fundamentals of low supply and strong demand.

Along with all of the uncertainties, the BC Provincial government recently introduced budget measures that will impact the real estate industry. They are:

a) Metro Vancouver (already included)

b) Fraser Valley Regional District

c) Capital Regional District (Victoria)

d) Regional District of Central Okanagan (Kelowna)

e) Regional District of Nanaimo

While the BC Provincial government has pushed these reforms as affordability measures, they may in fact encourage wealthier buyers to compete for cheaper properties or rent. This could push up rents and prices for entry-level homes. Consequently, some of these policies appear to be pure tax increases rather than honest efforts to improve housing affordability for British Columbians.